### Understanding Eligibility for San Francisco Health Care Security Ordinance

Greetings! As a seasoned attorney, I am here to provide you with a clear and detailed explanation of the eligibility requirements for the San Francisco Health Care Security Ordinance (HCSO). The HCSO is a local law that requires certain employers in San Francisco to provide health care benefits to their employees.

📋 Content in this article

1. Covered Employers: The HCSO applies to private sector employers with 20 or more employees, as well as nonprofits with 50 or more employees. Covered employers must comply with the HCSO regardless of whether their employees work full-time, part-time, or are temporary workers.

2. Covered Employees: To be eligible for health care benefits under the HCSO, an employee must work at least 8 hours per week in San Francisco. This includes part-time, full-time, and temporary employees. Independent contractors, government employees, and certain other categories of workers are not covered by the HCSO.

3. Waiting Periods: Employers are required to offer health care benefits to eligible employees within 90 days of their start date. The waiting period for benefits cannot exceed 90 days, and during this waiting period, employers must provide interim coverage.

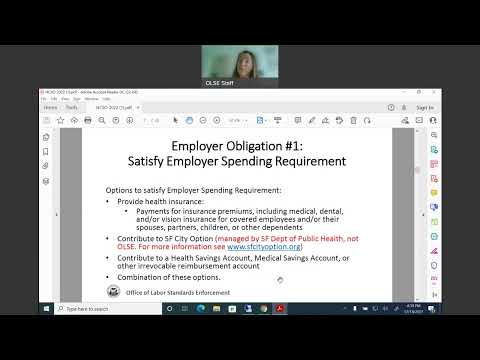

4. Health Care Expenditure Rates: Employers have two options for complying with the HCSO. They can either make required health care expenditures on behalf of their employees or they can contribute to the City Option program. The health care expenditure rates are adjusted annually based on the number of employees.

5. Reporting and Record Keeping: Covered employers must keep records documenting their compliance with the HCSO for at least four years. This includes employee information, health care expenditure documentation, and proof of offering coverage.

6. Penalties and Enforcement: Failure to comply with the HCSO can result in penalties and fines. The Office of Labor Standards Enforcement (OLSE) is responsible for enforcing the HCSO and investigating complaints filed by employees.

It is important for employers in San Francisco to understand their obligations under the HCSO and ensure compliance to avoid potential legal issues. For further guidance, it is recommended to consult with legal professionals who specialize in employment law or contact the OLSE for specific inquiries.

Remember, complying with the HCSO not only ensures the well-being of your employees but also helps maintain a healthy and equitable working environment in San Francisco.

Understanding the Healthcare Accountability Ordinance in San Francisco: A Comprehensive Overview

Understanding Eligibility for San Francisco Health Care Security Ordinance: A Comprehensive Overview

The San Francisco Health Care Security Ordinance (HCSO) is a landmark legislation that aims to provide access to affordable healthcare for employees in the city. This ordinance requires certain employers to make contributions towards their employees’ healthcare expenses. One important aspect of the HCSO is understanding eligibility criteria, which determines who is entitled to receive these benefits.

Key Points:

Full-Time Employees:

Full-time employees are those who work at least 40 hours per week. They are eligible for full healthcare benefits under the HCSO. However, employers may require a waiting period of up to 90 days before these benefits kick in.

Part-Time Employees:

Part-time employees work fewer than 40 hours per week but at least 8 hours per week. They are also eligible for healthcare benefits under the HCSO, but the level of benefits may be reduced based on the number of hours worked. Employers must provide pro-rated benefits that correspond to the number of hours worked.

Collective Bargaining Agreements:

Employees covered by a valid collective bargaining agreement (CBA) may have different eligibility requirements as negotiated in the agreement. The terms of the CBA must meet or exceed the requirements of the HCSO.

Exemptions:

Certain categories of employees are exempt from the HCSO, including managerial, professional, and confidential employees. Additionally, employees who are covered by Medicare or specific government programs are also exempt.

Understanding the Healthy San Francisco Mandate: An In-depth Overview

Understanding Eligibility for San Francisco Health Care Security Ordinance

The San Francisco Health Care Security Ordinance (HCSO) is a local law that requires employers to provide health care benefits to their covered employees. Under this ordinance, eligible employees working in San Francisco must be provided with health care coverage or the equivalent in health care spending.

To determine whether an employee is eligible for coverage under the HCSO, several key factors need to be considered:

1. Employer Size: The HCSO applies to all employers with 20 or more employees, regardless of whether those employees work part-time or full-time. Employers with fewer than 20 employees are exempt from this ordinance.

2. Hours Worked: An employee must work at least 8 hours per week within the geographic boundaries of San Francisco to be eligible for coverage. This includes both part-time and full-time employees.

3. Length of Employment: In order to be eligible, an employee must have been employed for at least 90 calendar days by the same employer. This requirement ensures that new employees are given a reasonable amount of time before becoming eligible for coverage.

4. Exempt Employees: Certain categories of employees are exempt from the HCSO, including government employees, employees covered by Medicare or TRICARE, and employees covered by collective bargaining agreements that meet specific requirements.

Once an employee meets these eligibility criteria, they are entitled to health care coverage or the equivalent health care spending from their employer. The HCSO allows employers to satisfy this requirement by either directly providing health care coverage or contributing a specified amount to a Health Reimbursement Account (HRA) or a comparable program.

It is important to note that the HCSO has specific rules regarding employer contributions to HRAs. These rules are based on the size of the employer and whether the employee is enrolled in individual or family coverage.

In conclusion, understanding eligibility for the San Francisco Health Care Security Ordinance is crucial for both employers and employees. Employers must ensure compliance with the ordinance by providing appropriate health care coverage or the equivalent spending, while employees should be aware of their rights and entitlements under this local law.

If you have any questions or need further information about the San Francisco Health Care Security Ordinance and your eligibility, it is recommended that you consult with a legal professional who specializes in employment law.

Understanding the San Francisco Health Airport Ordinance: A Comprehensive Guide

Understanding Eligibility for San Francisco Health Care Security Ordinance: A Comprehensive Guide

Introduction:

The San Francisco Health Care Security Ordinance (HCSO) is a landmark law that ensures access to healthcare for eligible workers in San Francisco. The HCSO mandates employers to provide health care benefits to their employees or make contributions to a city-administered fund. To understand the HCSO better, it is important to grasp the concept of eligibility. This comprehensive guide aims to provide a detailed understanding of the eligibility criteria under the San Francisco HCSO.

Key Points:

1. Covered Employers:

– The HCSO applies to employers who operate in San Francisco and employ at least 20 employees.

– Non-profit organizations with 50 or more employees are also covered under the HCSO.

– The number of employees is determined by calculating the average number of individuals employed per week in the past calendar year.

2. Eligible Employees:

– To be eligible for benefits under the HCSO, an employee must work for a covered employer for at least 8 hours per week.

– Employees who have worked for a covered employer for 90 days or more are considered eligible.

– Independent contractors, government employees, and employees covered under Medicare or TRICARE are not eligible under the HCSO.

3. Types of Health Care Benefits:

– Covered employers must provide one of four types of health care benefits to eligible employees:

4. Employer Contributions:

– Employers who do not provide health care benefits directly must make quarterly contributions to the San Francisco City Option.

– The contribution amount varies based on the number of employees and the employer’s annual payroll expenses.

5. Compliance and Reporting Requirements:

– Employers must maintain records of employee hours, wages, and benefits provided for a period of 4 years.

– Annual reporting to the City of San Francisco is required, including the number of employees, benefits provided, and contribution amounts if applicable.

As an attorney practicing in the United States, it is important to stay informed about various laws and regulations that may impact individuals and businesses. One such regulation is the San Francisco Health Care Security Ordinance (HCSO), which provides certain benefits to employees working in San Francisco. Understanding the eligibility requirements of the HCSO is crucial to ensure compliance with the law and to avoid potential legal consequences.

The HCSO requires covered employers to make minimum health care expenditures on behalf of their covered employees. To determine if an employer is subject to the HCSO, it is necessary to consider factors such as the number of employees and hours worked by employees within the city limits of San Francisco. The HCSO also establishes eligibility criteria for covered employees, which must be met in order for them to receive benefits under the ordinance.

Eligibility

To be eligible for benefits under the HCSO, an employee must meet certain requirements. These requirements include:

1. Employment status: The employee must be considered a “covered employee” under the HCSO. This typically includes employees who work a certain number of hours within San Francisco.

2. Minimum hours worked: The employee must have worked a minimum number of hours within a specified period, usually during a calendar quarter or a calendar year.

3. Average hourly rate: The employee’s average hourly rate must meet or exceed a certain threshold set by the HCSO. This threshold is typically adjusted annually based on inflation.

4. Employer size: The size of the employer also plays a role in determining eligibility. Different rules may apply depending on whether the employer is considered a small or large business under the HCSO.

It is important to note that the eligibility criteria may change over time as new regulations are enacted or existing ones are amended. Therefore, it is crucial for attorneys and individuals to stay up-to-date on the latest developments related to the HCSO.

Importance of Staying Up-to-Date

Staying up-to-date on the eligibility criteria of the HCSO is crucial for several reasons:

1. Compliance: By understanding the eligibility requirements, employers can ensure compliance with the law and avoid potential legal consequences.

2. Employee Benefits: Employees who meet the eligibility criteria are entitled to certain benefits under the HCSO, such as health care expenditures made by their employer. Being aware of these benefits can help employees assert their rights and ensure they receive the benefits they are entitled to.

3. Legal Advice: Attorneys who stay informed about the HCSO can provide accurate and reliable advice to their clients, helping them navigate the complexities of the ordinance and make informed decisions.

4. Changes in Eligibility Criteria: The eligibility criteria of the HCSO may change over time due to legislative amendments or judicial interpretations. Staying updated will ensure that attorneys and individuals are aware of any changes that may impact their rights or obligations under the law.

While this article provides a general overview of the eligibility requirements for the San Francisco Health Care Security Ordinance, it is important for readers to verify and contrast the content with the most recent version of the ordinance and consult with legal professionals for specific guidance tailored to their circumstances.