Greetings! As an experienced attorney in the United States, I am here to shed light on the topic of finding the home insurance company with the highest customer satisfaction. In this informative article, we will explore important factors to consider when evaluating insurance providers and uncover the company that consistently exceeds customer expectations. So, let’s dive right in!

Unveiling the Home Insurance Company with the Highest Customer Satisfaction

Unveiling the Home Insurance Company with the Highest Customer Satisfaction

📋 Content in this article

When it comes to selecting a home insurance company, customer satisfaction should be at the top of your priority list. After all, you want to ensure that your investment is protected and that you will receive the support you need in the event of a claim. To help you make an informed decision, we have compiled a comprehensive guide to unveil the home insurance company with the highest customer satisfaction.

Why is customer satisfaction important in home insurance?

Customer satisfaction plays a crucial role in the insurance industry, especially in the realm of home insurance. When you purchase a policy, you are essentially entering into a contract with the insurance company. In exchange for paying your premiums, you expect the company to fulfill its obligations and provide the coverage and support promised. If a company has a history of dissatisfied customers, it may be an indicator of poor service, delayed claim processing, or unfair settlement practices.

How is customer satisfaction measured?

Measuring customer satisfaction can be challenging, but various methods are used to gauge how satisfied customers are with their insurance companies. One common approach is through customer surveys, where policyholders are asked about their overall experience, claims handling, communication, and other factors. Ratings and reviews collected from reputable sources can also provide valuable insights into a company’s performance and customer satisfaction levels.

Identifying the home insurance company with the highest customer satisfaction

To identify the home insurance company with the highest customer satisfaction, several factors need to be considered:

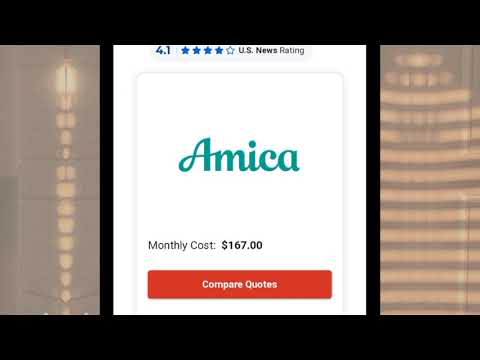

1. Ratings and reviews: Look for reputable sources that provide unbiased ratings and reviews of insurance companies. These sources often consider factors such as customer service, claims handling, and overall satisfaction when assigning ratings.

2. Industry awards: Pay attention to insurance companies that have received industry recognition for their exceptional customer service. Awards highlight companies that go above and beyond to satisfy their policyholders.

3. Word-of-mouth: Talk to friends, family, and neighbors who have filed claims with their insurance providers. Their personal experiences can provide insights into the level of customer satisfaction.

4. Professional advice: Consult with an insurance agent or broker who can provide guidance based on their knowledge and experience working with different insurance companies. They can offer insights into customer satisfaction levels and help you select the right company for your needs.

Which Insurance Company Has the Highest Customer Satisfaction Rating: A Comparative Analysis

Unveiling the Home Insurance Company with the Highest Customer Satisfaction: A Comparative Analysis

When it comes to protecting your home, having the right insurance coverage is crucial. However, with so many insurance companies out there, how do you know which one will provide you with the highest level of customer satisfaction? This article aims to help you make an informed decision by conducting a comparative analysis of various insurance companies.

1. Researching Customer Satisfaction Ratings:

To determine which insurance company has the highest customer satisfaction rating, extensive research is required. Look for reputable sources that conduct customer satisfaction surveys in the insurance industry. These surveys often evaluate factors such as claim handling, policy options, customer service, and overall customer experience. Some well-known sources for this kind of information include J.D. Power, Consumer Reports, and the Better Business Bureau.

2. Reviewing the Methodology:

When reviewing customer satisfaction ratings, it’s important to understand the methodology used by each source. Different organizations may use different criteria and weighting systems to calculate their ratings. Pay attention to whether the ratings are based on objective data or subjective opinions. Additionally, check if the surveys are conducted on a national or regional level.

3. Comparing Insurance Companies:

Once you have gathered customer satisfaction ratings from multiple sources, compare them side by side. Look for patterns and consistent high ratings among different insurance companies. It’s important to consider both the overall satisfaction rating as well as specific categories that are relevant to you, such as claims handling or customer service.

4. Considering Other Factors:

While customer satisfaction ratings are an important factor in choosing an insurance company, they should not be the sole basis for your decision. Consider other factors that are important to you, such as policy coverage options, pricing, financial stability, and reputation in the industry. Reviewing independent ratings agencies like A.M. Best can provide insight into an insurance company’s financial strength and stability.

5. Seeking Recommendations:

In addition to conducting your own research, don’t hesitate to seek recommendations from friends, family, or colleagues who have had positive experiences with their home insurance providers. Their personal experiences can provide valuable insights and help you narrow down your choices.

The Ultimate Guide to Choosing a Reliable Insurance Company

The Ultimate Guide to Choosing a Reliable Insurance Company

When it comes to protecting your home and your valuable possessions, having a reliable insurance company by your side is crucial. With so many options available, it can be overwhelming to choose the right one. However, by following this ultimate guide, you can make an informed decision and select an insurance company that will provide the highest level of customer satisfaction.

By following these steps and considering these factors, you can make an informed decision and choose a reliable insurance company that will provide you with the highest level of customer satisfaction. Remember, taking the time to research and evaluate your options now can save you from headaches and financial loss in the future.

Unveiling the Home Insurance Company with the Highest Customer Satisfaction

As an attorney practicing in the United States, it is crucial to stay up-to-date on various topics relevant to our profession. One such topic that holds significant importance is the performance and customer satisfaction of home insurance companies. Understanding which company has the highest customer satisfaction can be beneficial for both legal professionals and their clients when dealing with property-related matters and insurance claims.

In today’s digital age, finding information on customer satisfaction has become relatively easy. Several consumer review websites and independent organizations compile data and provide rankings based on customer feedback and experiences. While these rankings can provide a general idea of a company’s performance, it is essential to verify and contrast the content before drawing any conclusions.

When exploring the topic of home insurance companies with the highest customer satisfaction, it is crucial to consider a few key factors. These factors can help determine the reliability of the information and ensure that the data you rely on is accurate and trustworthy.

1. Source of Information: Determine the source of the information or ranking. Is it a reputable organization known for its unbiased evaluations? Look for established entities that have a proven track record of conducting impartial research and analysis.

2. Methodology: Understand the methodology used to compile the rankings or customer satisfaction data. Does it involve surveys, interviews, or objective measurements? A transparent methodology that incorporates a diverse range of factors will provide more reliable results.

3. Sample Size: Consider the sample size of customers surveyed or considered in the evaluation process. A larger sample size generally leads to more accurate and representative results.

4. Scope: Assess whether the rankings or evaluations focus specifically on home insurance or encompass a broader range of insurance products and services. Evaluations specific to home insurance will provide more relevant insights for your purposes.

Once you have identified a reliable source of information and evaluated their methodology, you can begin comparing the customer satisfaction ratings of different home insurance companies. It is important to keep in mind that customer satisfaction can vary based on individual experiences and expectations. While a company may have a high overall rating, it does not guarantee a positive experience for every policyholder.

To make an informed decision, consider additional factors such as the coverage options, policy terms and conditions, financial stability, and customer service offered by the insurance companies under consideration. These factors are critical in ensuring the best possible outcome for your clients when dealing with property-related legal matters.

In conclusion, as attorneys, we must stay up-to-date on topics such as the performance and customer satisfaction of home insurance companies. While it is useful to identify the company with the highest customer satisfaction, it is equally important to verify and contrast the rankings or information provided. By considering the source of information, methodology, sample size, and scope, we can make informed decisions that benefit our clients and help navigate property-related legal issues effectively.