Welcome to this informative article on analyzing the comparative risk levels of various contracts in the context of US law. It is important to note that while this article aims to provide a comprehensive overview of the topic, it should not be considered as a substitute for consulting other reliable sources or seeking legal advice from professionals.

Understanding Contract Risk Analysis: A Comprehensive Overview

An Overview of Contract Risk Analysis: Understanding Comparative Risk Levels

In the world of business, contracts play a crucial role in establishing legally binding agreements between parties. Whether it’s a simple purchase agreement or a complex partnership contract, understanding and assessing the risks associated with these agreements is of utmost importance. This is where contract risk analysis comes into play.

📋 Content in this article

Contract risk analysis is a comprehensive process that involves carefully examining and evaluating the potential risks and uncertainties associated with a contract. By conducting a thorough analysis, individuals and businesses can gain a deeper understanding of the potential pitfalls and liabilities they may encounter. This enables them to make informed decisions and mitigate any potential harm that could arise from entering into the contract.

To analyze the comparative risk levels of various contracts, several key factors should be taken into consideration:

Understanding the Comparative Risk Assessment Model: An In-Depth Analysis

Understanding the Comparative Risk Assessment Model: An In-Depth Analysis

When it comes to analyzing the comparative risk levels of various contracts, understanding the Comparative Risk Assessment Model is of utmost importance. This model serves as a framework for evaluating and comparing the risks associated with different contractual arrangements. By utilizing this model, parties can make informed decisions and allocate resources accordingly.

To begin with, it is crucial to grasp the concept of comparative risk assessment. This process involves identifying and evaluating risks in order to determine their likelihood of occurrence and potential impact. By comparing these risks across different contracts, parties can assess which options carry higher or lower levels of risk.

Now, let’s delve into the key components of the Comparative Risk Assessment Model:

1. Risk Identification: This step involves identifying and documenting all potential risks associated with a particular contract. It is essential to be thorough and comprehensive during this stage to ensure all risks are properly considered.

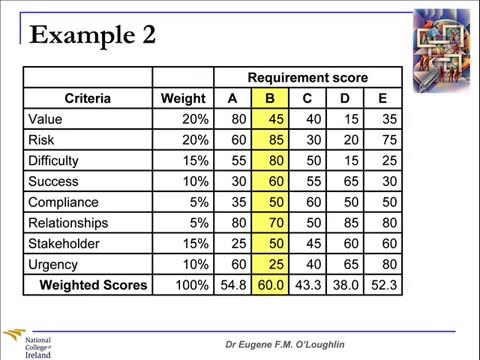

2. Risk Evaluation: Once the risks have been identified, they must be evaluated in terms of their likelihood and potential impact. This evaluation can be subjective to some extent, as it relies on expert judgment and analysis based on past experiences or industry standards.

3. Risk Comparison: The next step is to compare the risks across different contracts. This comparison can be done by assigning a numerical value or score to each risk based on its severity or probability of occurrence. By doing so, parties can objectively assess and rank the risks associated with each contract.

4. Risk Mitigation: After comparing the risks, parties should develop strategies to mitigate or minimize them. This may involve implementing safeguards, insurance policies, or contractual provisions that allocate responsibilities and liabilities in a way that reduces overall risk exposure.

5. Decision Making: Armed with a comprehensive understanding of the risks and their comparative levels, parties can make informed decisions.

Title: Staying Current: Analyzing the Comparative Risk Levels of Various Contracts

Introduction:

In the complex world of US law, understanding the comparative risk levels associated with different contracts is essential. Contracts form the backbone of legal agreements, governing relationships between parties and setting out their rights and obligations. As an expert in US law, I am committed to providing an informative reflection on the significance of staying current on this topic. It is important to note that readers should always verify and cross-reference the information provided in this article, as laws can vary across jurisdictions and evolve over time.

1. Understanding Contractual Risk:

Contracts are legal documents that outline the terms and conditions agreed upon by parties entering into an agreement. They serve to minimize uncertainty and ensure that both parties are aware of their rights, obligations, and potential risks. By analyzing the comparative risk levels of various contracts, individuals can make informed decisions and protect their interests.

2. Identifying Risk Factors:

The first step in analyzing the risk levels of contracts involves identifying and understanding the potential risk factors involved. These factors can include financial risks, performance risks, legal risks, and external risks such as force majeure events or changes in government regulations. Each contract may have unique risk factors that need to be carefully evaluated.

3. Assessing Comparative Risk Levels:

Once the risk factors have been identified, it is crucial to assess the comparative risk levels of different contracts. This assessment involves evaluating the likelihood of each risk occurring and its potential impact on the parties involved. Comparative risk analysis allows individuals to prioritize their contractual obligations and make informed decisions about risk mitigation strategies.

4. The Importance of Staying Current:

Staying current on the comparative risk levels of various contracts is vital for several reasons:

a) Legal Environment: Laws are not static; they evolve and change over time. Staying updated on relevant statutes, regulations, and court decisions is crucial to accurately analyze contractual risk levels.