Understanding the Enforceability of Broker Commissions in US Law

Hello and welcome to this informative article on the topic of understanding the enforceability of broker commissions in US law. Before we delve into the intricacies of this subject, it is important to note that while we strive to provide accurate and up-to-date information, it is always advisable to cross-reference with other sources or consult legal advisors for specific advice.

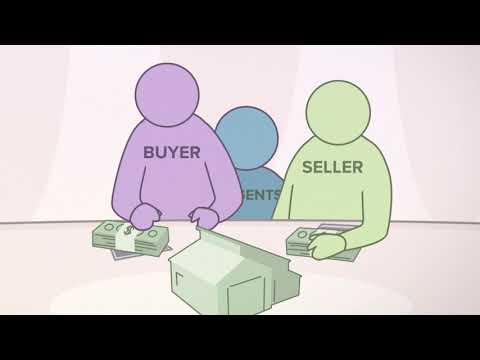

Now, let’s embark on our journey to demystify the world of broker commissions in the United States. Brokers play a vital role in various industries, acting as intermediaries between buyers and sellers, landlords and tenants, or even employers and employees. They facilitate transactions, negotiate deals, and provide valuable expertise.

📋 Content in this article

One crucial aspect of broker-client relationships is the payment of commissions. A commission is a fee that a broker receives for their services, typically calculated as a percentage of the transaction value. It serves as an incentive for brokers to diligently work towards achieving the best outcomes for their clients.

However, the enforceability of broker commissions can sometimes become a contentious issue. Disputes may arise when clients question the value of the services provided or feel that the broker did not fulfill their contractual obligations. In such cases, understanding the legal framework surrounding broker commissions becomes essential.

Here are some key points to consider:

1. Written Agreements: In most states, for a broker to be entitled to a commission, there must be a written agreement between the broker and their client. This agreement outlines the scope of services, the commission rate, and any other relevant terms.

2. Performance and Procuring Cause: To enforce a commission, brokers must typically show that they have performed the agreed-upon services and were the procuring cause of the transaction. In other words, they must demonstrate that their actions directly led to the completion of the deal.

3. Fraud, Misrepresentation, or Breach: If

Understanding the Legal Framework Safeguarding Broker’s Commission in the United States

Understanding the Enforceability of Broker Commissions in US Law

In the United States, broker commissions play a significant role in various industries, particularly in real estate and financial services. Brokers act as intermediaries between buyers and sellers, facilitating transactions and providing valuable expertise. As a potential client, it is crucial to understand the legal framework surrounding broker commissions to ensure fair and transparent dealings. This article aims to provide a comprehensive overview of the enforceability of broker commissions under US law.

1. The Role of Broker Commissions

Broker commissions serve as a form of compensation for the services rendered by brokers. These commissions are typically a percentage of the total transaction value and are paid by the party who engaged the broker’s services. For instance, in real estate, the seller usually pays the broker commission upon the successful sale of the property.

2. Contractual Agreements

The enforceability of broker commissions primarily stems from contractual agreements between the parties involved. A well-drafted contract explicitly outlining the terms and conditions of the commission arrangement is crucial to ensure enforceability. These contracts typically specify the scope of services, commission rates, payment terms, and any contingencies or circumstances that may affect commission entitlement.

3. Statutory Regulations

Apart from contractual agreements, certain statutory regulations govern broker commissions in specific industries. These regulations may vary from state to state and are designed to protect both brokers and consumers. It is crucial to familiarize yourself with the relevant laws in your jurisdiction to ensure compliance.

4. Performance of Services

In general, broker commissions are enforceable when

Situations Where a Broker may not be Entitled to a Commission in US Law

Understanding the Enforceability of Broker Commissions in US Law

In the realm of real estate transactions, brokers play a crucial role by connecting buyers and sellers and facilitating the closing of deals. As part of their services, brokers typically expect to receive a commission, which is a fee based on a percentage of the final sale price. However, there are certain situations where a broker may not be entitled to a commission under US law. It is important for both buyers and sellers to be aware of these circumstances to avoid any disputes or legal issues.

1. Failure to Procure Cause

One situation where a broker may not be entitled to a commission is if they fail to fulfill their obligation of procuring a cause for the sale or purchase of the property. In other words, if the broker’s actions or inactions directly lead to the deal falling through, they may not be able to claim a commission. For example, if a buyer decides not to proceed with the purchase because the broker misrepresented important information about the property, the broker may not be entitled to a commission.

2. Breach of Fiduciary Duty

Brokers owe their clients a fiduciary duty, which means they must act in the best interests of their clients and prioritize their clients’ needs above their own. If a broker breaches this duty by engaging in dishonest or unethical behavior, they may not be entitled to a commission. For instance, if a broker accepts a bribe from a seller to prioritize their property over other listings, they may lose their right to claim a commission.

3. Lack of Written Agreement

In many jurisdictions, including the United States, it is common practice for brokers and clients to enter into written agreements that outline the terms and conditions of their relationship. If there is no written agreement in place that clearly specifies the broker’s entitlement to a commission, it may be difficult for the broker to enforce their claim.

Understanding the Enforceability of Broker Commissions in US Law

In the realm of US law, broker commissions play a significant role in various transactions, particularly in the context of real estate. A broker acts as an intermediary between parties involved in a transaction and receives a commission as compensation for their services. However, it is crucial to comprehend the enforceability of broker commissions to avoid any legal complications.

To begin with, it is important to note that US law does not provide a uniform set of rules governing broker commissions. Instead, these rules vary from state to state, making it essential for individuals engaged in transactions involving brokers to stay updated on the specific laws of their jurisdiction. Therefore, verifying and cross-referencing the information provided in this article with the relevant state statutes and case law is highly recommended.

One fundamental principle that remains consistent across most jurisdictions in the US is that for a broker to be entitled to a commission, there must be a valid and enforceable contract between the broker and the party they represent. This contract typically outlines the scope of the broker’s services, the agreed-upon commission rate or amount, and any specific conditions triggering the entitlement to the commission.

In addition to a valid contract, another critical factor determining the enforceability of broker commissions is whether the broker has fulfilled their contractual obligations. Brokers are generally expected to act in good faith, exercise reasonable care and skill, and work diligently to facilitate the transaction. If a broker fails to meet these standards or breaches their contractual duties, it may affect their right to claim a commission.

Furthermore, it is prudent for parties involved in a transaction to understand the concept of procuring cause. Procuring cause refers to the actions or efforts by which a broker brings about a successful transaction. To be entitled to a commission as the procuring cause, a broker must establish that their actions were the primary factor leading to the completion of the transaction.