Understanding the Williamson Act in Napa County: A Comprehensive Guide

Greetings, esteemed readers! Today, we embark upon a journey of knowledge, exploring the intricacies of the Williamson Act in Napa County. Whether you are a landowner, real estate enthusiast, or simply curious about the legal landscape, this comprehensive guide will equip you with a deeper understanding of this significant legislation.

📋 Content in this article

1. Introduction to the Williamson Act:

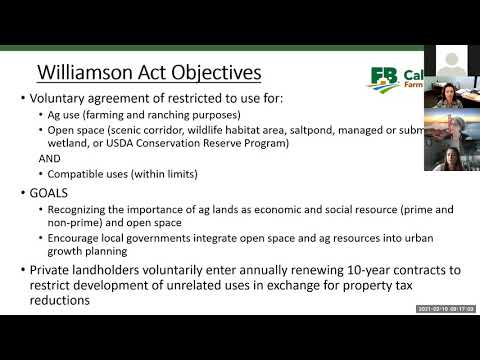

The Williamson Act, officially known as the California Land Conservation Act of 1965, was established to preserve agricultural lands in California. Named after John Williamson, a state senator who championed its creation, the act provides tax incentives to landowners who commit to long-term agricultural use of their properties.

2. Purpose and Benefits:

The primary purpose of the Williamson Act is to protect agricultural resources from urban development. By enrolling their land under this act, property owners may benefit from reduced property tax assessments, thereby incentivizing the preservation of open spaces, wildlife habitats, and agricultural productivity. The act encourages landowners to embrace sustainable agricultural practices and safeguards the rural character of areas like Napa County.

3. Contract Terms:

To participate in the Williamson Act, landowners must enter into a ten-year contract with their county government. This agreement obligates them to maintain their land for agricultural purposes during the contract term. It is crucial to note that withdrawing from the contract prematurely may result in substantial penalties, as determined by state law and local ordinances.

4. Process of Enrollment:

To enroll in the Williamson Act in Napa County, landowners must submit an application to the county’s agricultural commissioner or assessor’s office. The application typically requires detailed information about the property and its current use for agriculture. The county authorities will review the application and determine whether the property meets the eligibility criteria for participation in the program.

5. Eligibility Criteria:

Not all lands are eligible for enrollment in the Williamson Act. Generally, properties must be primarily devoted to agricultural use, meet minimum acreage requirements, and not be designated as prime agricultural land. The specific eligibility criteria may vary slightly from county to county, so it is prudent to consult local regulations or seek professional guidance to ensure compliance.

6. Effects on Property Taxes:

Upon successful enrollment in the Williamson Act, property owners may benefit from reduced property tax assessments. The property’s value is assessed based on its agricultural productivity rather than its potential for development. Consequently, landowners may experience a decrease in property taxes, making it more financially feasible to maintain the land for agricultural purposes.

In conclusion, the Williamson Act plays a vital role in preserving the agricultural heritage of Napa County and other regions in California. By offering tax incentives, it encourages landowners to commit to agricultural use and protects against urban sprawl. Understanding the act’s purpose, benefits, contract terms, enrollment process, eligibility criteria, and effects on property taxes is essential for anyone considering participation in this program.

Remember, this guide is merely an overview of the topic, and it is always advisable to consult legal professionals or relevant government authorities for specific advice tailored to your unique circumstances.

Understanding the Williamson Act in Napa County: A Comprehensive Guide

Understanding the Williamson Act in Napa County: A Comprehensive Guide

Welcome to our comprehensive guide on understanding the Williamson Act in Napa County. In this article, we will provide you with detailed information on the Williamson Act, its significance, and its impact on landowners in Napa County.

Introduction to the Williamson Act

The Williamson Act, also known as the California Land Conservation Act of 1965, is a state law that provides property tax relief to landowners who agree to restrict their land to agricultural or open space uses for a specified period of time. The purpose of the act is to encourage the preservation of agricultural lands and open space in California.

Goals and Benefits of the Williamson Act

The primary goal of the Williamson Act is to protect agricultural lands from urban development and promote sustainable land use practices. By providing property tax relief, the act helps alleviate the financial burden on landowners, making agricultural and open space uses more economically viable.

Some of the key benefits of participating in the Williamson Act include:

1. Property Tax Savings: Landowners who enroll their land under the Williamson Act receive reduced property tax assessments based on its agricultural or open space value, rather than its potential development value. This tax savings can be substantial and provide long-term financial stability for landowners.

2. Land Preservation: By restricting land use to agricultural or open space purposes, the Williamson Act helps preserve valuable farmland and open space areas from encroaching urban development. This, in turn, supports local food production, environmental conservation, and the overall quality of life in Napa County.

3. Conservation Easements: Under the Williamson Act, landowners may also enter into conservation easements, which are legally binding agreements that permanently limit certain uses of the land. Conservation easements provide additional protection to natural resources and ensure that the land will remain in agricultural or open space use in perpetuity.

Eligibility and Enrollment Process

To be eligible for the Williamson Act in Napa County, the land must be designated as agricultural or open space land and meet certain minimum acreage requirements. The specific requirements may vary depending on the county and local regulations.

The enrollment process typically involves submitting an application to the local county assessor’s office, along with supporting documentation such as a land management plan and soil report. The assessor’s office will review the application and determine whether the land qualifies for Williamson Act enrollment.

Duration and Withdrawal

Once enrolled in the Williamson Act, landowners are required to maintain the agricultural or open space use for a minimum period of 10 years. This commitment ensures the long-term preservation of agricultural lands and open space.

However, there may be situations where a landowner wishes to withdraw from the Williamson Act before the end of the 10-year term. Withdrawal from the act may result in penalties, including the payment of back taxes and penalties for breaching the contractual obligations.

Understanding the Primary Objective of the Williamson Act: A Comprehensive Analysis of Land Use Regulations

Understanding the Primary Objective of the Williamson Act: A Comprehensive Analysis of Land Use Regulations

The Williamson Act is a crucial piece of legislation enacted in the State of California to preserve agricultural lands and discourage urban sprawl. The primary objective of the Williamson Act is to provide incentives to landowners who agree to maintain their properties for agricultural purposes for a specified period of time, typically 10 years or more. By enrolling in the Williamson Act program, landowners can benefit from property tax reductions, making it financially viable to continue agricultural operations.

Key Points:

The Purpose of Land Use Regulations:

Land use regulations, such as the Williamson Act, play a critical role in balancing economic development with environmental conservation. These regulations ensure that land is utilized in a manner that is consistent with the goals and needs of the community. By designating certain areas for specific uses, land use regulations help protect natural resources, preserve open spaces, and promote sustainable development.

In the case of the Williamson Act, the primary purpose is to safeguard agricultural lands and promote their long-term viability. Agricultural activities contribute significantly to California’s economy and provide numerous benefits, including job creation and food production. By offering incentives to landowners who commit to maintaining their properties for agricultural purposes, the Williamson Act encourages the preservation of these valuable lands.

The Benefits of the Williamson Act:

1. Preservation of Agricultural Lands: By enrolling in the Williamson Act program, landowners contribute to the preservation of valuable agricultural lands, protecting them from urban encroachment and conversion.

2. Property Tax Reductions: Participating landowners benefit from property tax reductions, which can provide substantial financial relief. These reductions help offset the costs associated with agricultural operations and make it more economically feasible for landowners to continue farming.

3. Long-Term Planning and Stability: The Williamson Act encourages landowners to engage in long-term planning for agricultural activities. By committing to maintaining their properties for a specified period, landowners can make informed decisions and invest in the long-term success of their agricultural operations.

4. Environmental Benefits: Preserving agricultural lands through the Williamson Act helps maintain open spaces, wildlife habitats, and natural resources. It contributes to the overall health and sustainability of the environment.

5. Community Benefits: The Williamson Act supports local economies by preserving agricultural activities that generate jobs and revenue. It also helps ensure a stable and reliable supply of locally grown food.

In conclusion, understanding the primary objective of the Williamson Act is essential for landowners who wish to preserve their agricultural lands while benefiting from property tax reductions. By enrolling in the program, landowners not only contribute to the conservation of California’s agricultural heritage but also secure the long-term viability of their farming operations. The Williamson Act plays a crucial role in promoting sustainable development and protecting the environment for future generations.

Understanding the Impact of the Williamson Act on Property Tax Reduction

Understanding the Williamson Act in Napa County: A Comprehensive Guide

If you own property in Napa County, it is essential to understand the impact of the Williamson Act on property tax reduction. The Williamson Act, officially known as the California Land Conservation Act of 1965, was enacted to encourage landowners to conserve agricultural and open space lands. This act provides property tax relief to landowners who agree to restrict their land to agricultural or open space uses for a specified period.

The purpose of the Williamson Act is to prevent the conversion of agricultural and open space lands into urban development. By offering property tax reductions, the act aims to incentivize landowners to preserve their land for agricultural or open space uses. In return, the landowners enter into a contract, also known as a Williamson Act contract, which places restrictions on the use and development of their property.

Here are key points to understand about the impact of the Williamson Act on property tax reduction in Napa County:

1. Eligibility: To be eligible for property tax reduction under the Williamson Act, your land must meet specific criteria. It should be classified as either agricultural land or open space land, as determined by the Napa County Assessor’s Office. Additionally, your land should be of a sufficient size and have the potential for long-term agricultural or open space uses.

2. Contract Requirements: To receive property tax reductions, you must enter into a Williamson Act contract with Napa County. This contract typically has a duration of ten years but can be extended for additional periods. The contract will outline the restrictions on the use and development of your property during the contract period.

3. Property Tax Reduction: Once you have entered into a Williamson Act contract, your property will be assessed at its restricted value rather than its market value. The restricted value is typically lower than the market value, resulting in lower property taxes. The exact percentage reduction in property taxes will depend on various factors, including the specific land use and location.

4. Contract Obligations: As a landowner under a Williamson Act contract, you have certain obligations to fulfill. These may include maintaining the property in agricultural or open space use, preventing incompatible uses, and complying with any additional contractual terms. Failure to meet these obligations can result in the cancellation of the contract and the loss of property tax reductions.

5. Transfer of Contract: It is important to note that a Williamson Act contract is binding on future owners of the property. If you sell or transfer the property, the new owner will be subject to the terms of the existing contract. This ensures the continuity of long-term agricultural and open space conservation efforts.

Understanding the impact of the Williamson Act on property tax reduction is crucial for property owners in Napa County. By participating in this program, landowners not only contribute to the preservation of agricultural and open space lands but also enjoy the benefits of reduced property taxes. Consult with a knowledgeable attorney or tax professional for further guidance on how the Williamson Act applies to your specific situation.

Understanding the Williamson Act in Napa County: A Comprehensive Guide

As an attorney practicing in the U.S., it is crucial to stay informed about the various laws and regulations that govern our communities. One such law that holds significant importance in Napa County is the Williamson Act. This comprehensive guide aims to provide readers with a clear understanding of the Williamson Act and its implications, while emphasizing the need to verify and contrast the information presented here.

The Williamson Act, officially known as the California Land Conservation Act of 1965, was enacted to encourage the preservation of agricultural land and open spaces. It gives landowners in Napa County the opportunity to enter into contracts with local government agencies, known as “Williamson Act contracts.” These contracts provide property tax relief to landowners who agree to restrict their land’s use for agricultural purposes for a specified period of time.

Under a Williamson Act contract, landowners commit to maintaining their property for agricultural use and refrain from non-agricultural development. In return, they receive property tax assessments based on the value of the land for agricultural purposes, rather than its potential market value for development. This tax reduction provides crucial financial relief to farmers and ranchers, enabling them to continue their agricultural operations despite increasing land values.

It is important for attorneys, along with landowners and other stakeholders, to stay up-to-date on the Williamson Act and any changes or updates that may occur. While this guide aims to provide a comprehensive overview of the Williamson Act, it is essential to verify and contrast the information presented here with current laws, regulations, and local ordinances.

To ensure accurate understanding of the Williamson Act in Napa County, consult official government sources such as county websites, local planning departments, or seek guidance from legal experts specializing in real estate and land use. These sources can provide the most current and accurate information regarding the application and interpretation of the Williamson Act.

Furthermore, it is important for attorneys to recognize that each county in California may have its own unique interpretations and regulations regarding the Williamson Act. Therefore, it is essential to research the specific laws and regulations applicable to Napa County when advising clients or engaging in legal matters related to the Williamson Act.

In conclusion, the Williamson Act plays a vital role in preserving agricultural land and open spaces in Napa County. As attorneys, it is our responsibility to stay informed about this law and its implications. However, it is crucial to verify and contrast the information presented here with current laws and regulations, as well as consult official sources and legal experts for accurate guidance. By doing so, we can provide our clients with the most reliable and up-to-date advice on matters related to the Williamson Act in Napa County.