Title: What You Need to Know About Basic Homeowners Insurance Policies

Introduction:

📋 Content in this article

Welcome to this informative article on basic homeowners insurance policies. As a seasoned attorney, I am here to provide you with a clear and detailed explanation of this essential coverage. Whether you are a new homeowner or seeking to better understand your existing policy, this article will help you navigate the complexities of homeowners insurance.

1. Understanding Homeowners Insurance:

Homeowners insurance is a type of property insurance that provides financial protection against damage or loss to your home and its contents. It offers coverage for various perils such as fire, theft, vandalism, and certain natural disasters. While policies can vary, they typically consist of several key components.

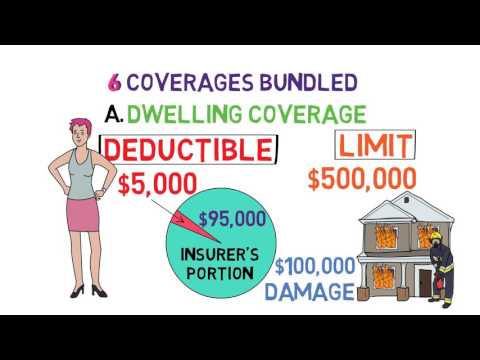

2. Dwelling Coverage:

The dwelling coverage component of a homeowners insurance policy protects the structure of your home itself. It includes coverage for damages caused by covered perils, such as fire or storm damage. The policy will typically pay for repairs or replacement costs up to the coverage limit stated in the policy.

3. Personal Property Coverage:

Personal property coverage protects your belongings within the insured property. This includes furniture, appliances, electronics, clothing, and other personal possessions. Similar to dwelling coverage, personal property coverage reimburses you for the cost of repairing or replacing damaged or stolen items, up to the coverage limit.

4. Liability Coverage:

Liability coverage is an essential component of homeowners insurance. It offers protection if someone is injured on your property or if you unintentionally cause damage to someone else’s property. This coverage helps pay for medical expenses, legal fees, and any court-awarded judgments up to the policy’s limit.

5. Additional Living Expenses:

In the unfortunate event that your home becomes temporarily uninhabitable due to a covered loss, homeowners insurance policies often include coverage for additional living expenses. This provision helps cover the costs of temporary housing, meals, and other necessary living expenses while your home is being repaired or rebuilt.

6. Policy Exclusions:

It is important to review the policy exclusions carefully. Homeowners insurance policies typically do not cover certain perils such as earthquakes, floods, or normal wear and tear. However, separate coverage options may be available for these risks.

Understanding the Basics of a Homeowners Insurance Policy

Understanding the Basics of a Homeowners Insurance Policy

When it comes to protecting your most valuable asset – your home – having a solid homeowners insurance policy in place is crucial. A homeowners insurance policy provides financial protection in the event that your home is damaged or destroyed, or if you are held liable for injuries or property damage that occurs on your property.

Here are the key points you need to know about basic homeowners insurance policies:

1. Coverage Types: A basic homeowners insurance policy typically includes four types of coverage:

2. Coverage Limits: Homeowners insurance policies typically have coverage limits, which are the maximum amounts the insurer will pay for covered losses. It’s important to review these limits and ensure they are adequate to cover the value of your home and belongings. If your coverage limits are too low, you may be responsible for paying out-of-pocket for any damages beyond the policy limits.

3. Deductibles: A deductible is the amount you are responsible for paying out-of-pocket before the insurance coverage kicks in. Higher deductibles typically result in lower premiums, but it’s important to choose a deductible that you can afford to pay in the event of a claim.

4. Exclusions: Homeowners insurance policies have certain exclusions, which are events or circumstances that are not covered by the policy. Common exclusions include damage caused by floods, earthquakes, and acts of war. It’s important to understand these exclusions and consider purchasing additional coverage if you live in an area prone to these risks.

5. Policy Terms: Homeowners insurance policies are typically term-based contracts, meaning they are in effect for a specific period of time, usually one year. It’s important to review your policy terms and understand when and how your coverage can be renewed or canceled.

6. Premiums: Your homeowners insurance premium is the amount you pay for the policy. Premiums are influenced by various factors, including the value of your home, your location, the coverage limits, and your claims history. It’s important to shop around and compare quotes from different insurance companies to get the best coverage at an affordable price.

In conclusion, understanding the basics of a homeowners insurance policy is essential for protecting your home and financial security. By knowing what is covered, the limits and deductibles, and any exclusions, you can make informed decisions about your coverage needs. It’s always a good idea to consult with an insurance professional who can help guide you through the process and ensure you have the right coverage for your specific circumstances.

Understanding the Components of a Standard Homeowners Insurance Policy

What You Need to Know About Basic Homeowners Insurance Policies

When it comes to protecting your most valuable asset – your home – having a basic homeowners insurance policy in place is essential. This type of insurance provides coverage for various perils that can damage or destroy your property, as well as protection against liability for injuries occurring on your premises. Understanding the components of a standard homeowners insurance policy will help you make informed decisions when choosing the right coverage for your needs. Below are the key components to consider:

1. Dwelling Coverage: This component of a homeowners insurance policy provides protection for the physical structure of your home and any attached structures, such as garages or decks. It typically covers damage caused by fire, storms, vandalism, and certain other perils specified in the policy. The coverage amount should reflect the cost to rebuild your home in case of a total loss.

2. Personal Property Coverage: This component covers your personal belongings, such as furniture, clothing, and electronics, against damage or theft. The coverage amount can be based on the actual cash value (ACV) or the replacement cost of the items. ACV takes depreciation into account, while replacement cost coverage allows you to replace damaged items with new ones without deducting for depreciation.

3. Liability Coverage: Liability coverage protects you if someone gets injured on your property and sues you for damages. It covers medical expenses, legal fees, and court-awarded damages up to the policy limit. It also extends beyond your home to certain incidents that occur off your premises, such as accidents caused by your pets.

4. Additional Living Expenses: If your home becomes uninhabitable due to a covered loss, this component helps cover the costs of temporary living arrangements, such as hotel stays or rental properties, until your home is repaired or rebuilt. The coverage typically includes expenses that exceed your normal living expenses.

5. Deductible: The deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. A higher deductible usually means lower premiums, but it also means you’ll have to pay more in the event of a claim. Choose a deductible amount that you are comfortable with and can afford to pay if necessary.

6. Exclusions and Limitations: It’s important to carefully review the policy’s exclusions and limitations. These are specific situations or circumstances that are not covered by your policy or have limited coverage. Common exclusions include damage caused by earthquakes, floods, or intentional acts. Make sure to understand any additional coverage options that may be available for these excluded perils.

7. Endorsements and Riders: Endorsements and riders are additional coverages that can be added to your basic homeowners insurance policy to provide extra protection or expand the coverage limits for specific items or perils. Examples can include coverage for expensive jewelry, fine arts, or identity theft.

It’s crucial to read and understand the terms and conditions of your homeowners insurance policy before purchasing it. Consult with an insurance professional to ensure you have the appropriate coverage for your home and personal circumstances. Remember, periodically reviewing and updating your policy as your needs change is essential for maintaining adequate protection.

Understanding the Basic Features of Homeowners Insurance Policies: A Comprehensive Guide

What You Need to Know About Basic Homeowners Insurance Policies

If you own a home, it is crucial to protect one of your most significant assets. Homeowners insurance provides financial coverage in the event of damage to your property or personal belongings. However, navigating the complexities of homeowners insurance policies can be overwhelming. In this guide, we will break down the basic features of homeowners insurance policies to help you understand what you need to know.

1. Dwelling Coverage:

Dwelling coverage is the primary component of a homeowners insurance policy. It protects the structure of your home, including walls, roof, floors, and other attached structures like garages or decks. It is important to determine the appropriate amount of dwelling coverage based on the cost to rebuild your home in case of a total loss.

2. Personal Property Coverage:

Personal property coverage provides protection for your belongings inside your home, such as furniture, clothing, electronics, and appliances. It is essential to assess the value of your personal property accurately to determine the appropriate coverage amount. Keep in mind that certain high-value items like jewelry or artwork may require additional coverage through endorsements or separate policies.

3. Liability Coverage:

Liability coverage protects you financially if someone is injured on your property or if you cause damage to someone else’s property. This coverage can help pay for medical expenses, legal fees, and damages awarded in a lawsuit. It is crucial to select sufficient liability coverage to protect your assets in case of a lawsuit.

4. Additional Living Expenses:

In the event that your home becomes uninhabitable due to a covered peril, additional living expenses (ALE) coverage can provide reimbursement for temporary living arrangements, such as hotel stays or rental properties. ALE coverage typically has limits and time restrictions, so understanding these limitations is important.

5. Deductibles:

A deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. It is important to select a deductible that you can comfortably afford. Typically, higher deductibles result in lower premiums, but it is crucial to strike a balance between affordability and the potential financial burden of a larger deductible.

6. Exclusions and Limitations:

Homeowners insurance policies have exclusions and limitations that specify what is not covered or has limited coverage. Common exclusions include flood damage, earthquakes, and normal wear and tear. Understanding these exclusions will help you make informed decisions about additional coverage, such as flood insurance or separate policies for valuable items.

7. Endorsements and Riders:

Endorsements and riders are additional coverages that can be added to your homeowners insurance policy to provide extra protection. Examples include coverage for home businesses, identity theft, or sewer backup. Carefully consider your needs and discuss with your insurance provider to determine if any endorsements or riders are necessary for your specific situation.

In conclusion, understanding the basic features of homeowners insurance policies is essential to ensure adequate protection for your home and personal belongings. By familiarizing yourself with the concepts of dwelling coverage, personal property coverage, liability coverage, additional living expenses, deductibles, exclusions, and endorsements, you can make informed decisions when selecting a homeowners insurance policy that suits your needs. Remember to consult with an insurance professional or attorney for personalized advice based on your unique circumstances.

What You Need to Know About Basic Homeowners Insurance Policies

As a homeowner, it is crucial to have a solid understanding of basic homeowners insurance policies. This knowledge empowers you to make informed decisions about protecting your most valuable asset – your home. However, it is important to note that insurance policies and their terms can vary, so it is always essential to verify and contrast the content of this article with the specific details of your policy.

1. Importance of Homeowners Insurance: Homeowners insurance is designed to protect you financially in case of damage to your home, personal property, or liability for injuries to others. It provides coverage for various perils, such as fire, theft, windstorm, and other specified events.

2. Dwelling Coverage: This component of homeowners insurance protects the structure of your home. It typically covers damage caused by fire, lightning, windstorms, hail, explosions, vandalism, and more. It is important to note that certain perils, such as earthquakes and floods, are typically not covered by standard policies and may require separate coverage.

3. Personal Property Coverage: This aspect of homeowners insurance protects your personal belongings, such as furniture, appliances, clothing, electronics, and more. If these items are damaged or destroyed due to covered perils, the insurance company will reimburse you for their value or replace them.

4. Liability Coverage: Liability coverage is an essential component of homeowners insurance. It protects you if someone is injured on your property and you are found legally responsible for their injuries or damages to their property. It can help cover medical expenses, legal fees, and damages awarded in a lawsuit.

5. Additional Living Expenses Coverage: If your home becomes uninhabitable due to a covered peril, this coverage will help pay for temporary living expenses, such as hotel stays, meals, and other related costs, until your home is repaired or rebuilt.

6. Policy Exclusions and Limitations: While homeowners insurance provides extensive coverage, it is crucial to understand the exclusions and limitations of your policy. Common exclusions include damage caused by floods, earthquakes, normal wear and tear, intentional acts, and certain types of personal property, such as jewelry or artwork. Additionally, policies may impose limitations on coverage for certain high-value items.

7. Deductibles: A deductible is the amount you must pay out-of-pocket before your insurance coverage kicks in. It is important to choose a deductible that you can comfortably afford in case of a claim. Generally, higher deductibles lead to lower premiums, but it is essential to find the right balance for your financial situation.

8. Policy Limits: Homeowners insurance policies have coverage limits for different components, such as dwelling coverage and personal property coverage. It is crucial to review these limits and ensure they adequately cover the value of your home and belongings. In certain cases, additional endorsements or separate policies may be necessary to fully protect high-value items.

9. Review and Update: Regularly reviewing and updating your homeowners insurance policy is essential. As your circumstances change, such as home improvements or acquiring valuable assets, it is crucial to inform your insurance provider to ensure you have adequate coverage.

10. Consult an Insurance Professional: If you have questions or need assistance understanding your homeowners insurance policy, it is advisable to consult with an insurance professional or agent. They can provide personalized guidance based on your specific needs and help you make informed decisions.

In conclusion, understanding the basics of homeowners insurance policies is essential for every homeowner. It allows you to protect your home, personal property, and finances in case of unforeseen events. Remember to verify and contrast the content of this article with the specific details of your policy to ensure you have the appropriate coverage for your needs.