Greetings readers,

Today, we will dive into the fascinating world of local government finance and explore a topic that is often overlooked but carries immense significance: understanding the largest expense for most local governments. Local governments, such as cities, counties, and townships, provide essential services to their communities, ranging from public safety and infrastructure development to education and healthcare. However, behind the scenes, these entities face a common challenge – managing their finances effectively.

📋 Content in this article

While local governments generate revenue through various sources such as taxes, fees, and grants, they also incur significant expenses in order to deliver the services their communities rely on. Among these expenses, one consistently stands out as the largest: employee compensation.

What is employee compensation?

Employee compensation refers to the wages, salaries, benefits, and other forms of remuneration that local government employees receive for their work. This includes not only the salaries of police officers, firefighters, teachers, and other public servants but also the costs associated with healthcare plans, retirement benefits, and paid time off.

Why is employee compensation the largest expense?

Local governments are labor-intensive organizations, meaning that they heavily rely on a skilled workforce to fulfill their duties. Whether it’s maintaining public facilities, enforcing regulations, or providing essential services, dedicated employees are at the forefront of delivering these services effectively. Consequently, employee compensation becomes the most significant expenditure for most local governments.

Breaking down employee compensation costs

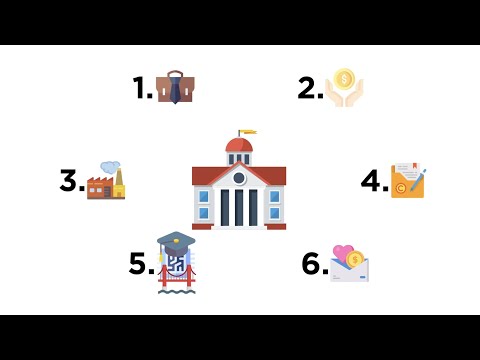

To understand the magnitude of employee compensation costs, it’s crucial to examine its components. These components generally include:

1. Base salaries: The fixed amount of money employees receive for their work, typically determined by job classification and experience level.

2. Benefits: These encompass a wide range of offerings, including health insurance, retirement plans such as pensions or 401(k)s, life insurance, disability coverage, and more.

3. Payroll taxes: Local governments are responsible for withholding and remitting payroll taxes on behalf of their employees. These taxes fund important programs such as Social Security and Medicare.

4. Other compensation: This category may include bonuses, overtime pay, and allowances for specific expenses.

The challenges of managing employee compensation

Managing employee compensation poses unique challenges for local governments. Firstly, it requires striking a balance between providing competitive salaries and benefits to attract and retain top talent while adhering to budgetary constraints. Secondly, local governments must also navigate the complexities of labor laws, collective bargaining agreements, and ever-changing regulations regarding employee benefits. Failure to properly manage employee compensation can lead to financial strain, workforce dissatisfaction, and potential legal issues.

In conclusion, understanding employee compensation as the largest expense for most local governments is key to comprehending the complexities of public finance. By recognizing the importance of managing these costs effectively, local governments can ensure the financial health of their communities while providing essential services that contribute to the well-being of their constituents.

Thank you for joining us on this enlightening journey into the world of local government finance.

Understanding the Major Expenditure for Local State Governments

Understanding the Largest Expense for Most Local Governments

Local governments, be it cities, counties, or townships, play a crucial role in providing essential services and maintaining the welfare of their communities. However, this responsibility comes at a cost. Understanding the largest expense for most local governments is vital for citizens and policymakers alike.

The largest expense: One key expenditure that consistently consumes a significant portion of local government budgets is personnel costs. These costs refer to the compensation and benefits received by employees, including salaries, wages, health insurance, retirement plans, and more.

Personnel costs: Local governments employ a diverse range of personnel to carry out various functions and services. This includes police officers, firefighters, sanitation workers, teachers, administrative staff, and many others. The salaries and benefits provided to these employees account for a substantial portion of a local government’s budget.

Factors contributing to personnel costs: Several factors contribute to the significant personnel costs incurred by local governments. These factors include:

The impact on local budgets: Given the significance of personnel costs, any changes in these expenses can have a substantial impact on local government budgets. Factors such as salary increases, benefit modifications, or changes in staffing levels can significantly affect a local government’s financial health and its ability to provide essential services.

Balancing the budget: To ensure the sustainability of their operations, local governments must carefully manage personnel costs while meeting the needs of their communities. This often requires careful budgeting, efficient resource allocation, exploring cost-saving measures, and evaluating the long-term impact of personnel decisions.

Transparency and citizen engagement: Understanding the largest expense for most local governments is essential for citizens to actively participate in the democratic process. By being informed about personnel costs and engaging in discussions with policymakers, citizens can contribute to shaping budgetary priorities that align with their community’s needs.

In conclusion, personnel costs represent the largest expense for most local governments. Understanding the factors driving these costs and their impact on local budgets is crucial for both policymakers and citizens. By comprehending this significant expenditure, individuals can actively participate in budgetary decisions and contribute to the long-term sustainability and well-being of their communities.

The Primary Financial Outlay for Local Governments: Unveiling the Largest Expenditure

Understanding the Largest Expense for Most Local Governments

When it comes to local government, it is crucial to have a clear understanding of the primary financial outlay. This refers to the largest expenditure that local governments face on a regular basis. By unraveling this concept, we can gain insights into the financial challenges and priorities that local governments must address.

What is the primary financial outlay for local governments?

The primary financial outlay for local governments refers to the largest expense that they incur. This expense typically constitutes a significant portion of their budget and encompasses various areas such as infrastructure, public safety, education, and social services. Identifying and comprehending this expense is essential for policymakers, taxpayers, and citizens alike.

Why is it important to understand the primary financial outlay?

Understanding the primary financial outlay is crucial for several reasons. Firstly, it allows policymakers to allocate resources effectively, ensuring that funds are prioritized towards areas that require the most attention. Secondly, taxpayers have a right to understand where their money is being spent and how it contributes to the betterment of their community. Lastly, citizens can use this knowledge to hold local governments accountable and actively engage in decision-making processes.

The largest expenditure: Unveiling the key areas

The largest expenditure for most local governments can vary depending on several factors such as population size, geographic location, and community needs. However, there are common areas that tend to consistently dominate local government budgets:

Strategies for managing the largest expense

Managing the largest expense requires careful planning and strategic decision-making. Here are a few strategies that local governments often employ:

In conclusion, understanding the primary financial outlay for local governments is essential for policymakers, taxpayers, and citizens. By identifying the largest expenditure areas and implementing effective strategies, local governments can ensure that resources are allocated wisely and in alignment with community needs.

Understanding the Primary Financial Burden of Local Governments: Unveiling the Largest Expense

Understanding the Largest Expense for Most Local Governments

Local governments, including cities, counties, and townships, are responsible for providing a wide range of services to their residents. These services can include infrastructure maintenance, public safety, education, and social services, among others. However, one common challenge that local governments face is managing their finances effectively in order to provide these services while maintaining a balanced budget.

The largest expense for most local governments is personnel costs. This includes salaries, benefits, and pensions for employees such as police officers, firefighters, teachers, and administrative staff. These personnel costs can account for a significant portion of a local government’s budget and can have a major impact on its financial health.

Salaries: Local governments employ a large number of individuals across various departments. These employees provide essential services to the community. Salaries for these employees are typically determined through collective bargaining agreements or civil service regulations. It is important for local governments to ensure that their employees are fairly compensated while also considering budgetary constraints.

Benefits: In addition to salaries, local governments also provide a range of benefits to their employees. These benefits can include healthcare coverage, retirement plans, paid time off, and other perks. Providing these benefits is important for attracting and retaining talented individuals in the public sector. However, the cost of these benefits can place a significant burden on local government budgets.

Pensions: Pensions are a major financial obligation for many local governments. Public sector employees often receive pensions that guarantee them a certain level of income during retirement. These pensions are typically funded through contributions from both the employee and the employer (the local government). However, due to factors such as longer life expectancies and economic fluctuations, the cost of funding these pensions can increase over time, putting strain on local government budgets.

Managing personnel costs is crucial for local governments in order to maintain financial stability. Failure to properly budget for these expenses can lead to budget deficits, increased borrowing, or cuts to essential services. Local governments must carefully analyze and project their personnel costs, taking into account factors such as salary increases, benefit changes, and pension fund performance.

In conclusion, understanding and effectively managing the largest expense for most local governments – personnel costs – is essential for maintaining a healthy financial position. By carefully examining salaries, benefits, and pension obligations, local governments can make informed decisions that balance the needs of their employees with the fiscal responsibilities to their constituents.

Understanding the Largest Expense for Most Local Governments

As a seasoned attorney practicing law in the United States, I have spent a significant amount of time studying and analyzing various aspects of government expenditure. One crucial area that stands out is understanding the largest expense for most local governments. This expense plays a pivotal role in shaping the economic landscape and determining the financial health of a community.

To comprehend the largest expense for local governments, it is essential to start with a clear definition. Local governments are responsible for providing a wide range of services to their residents, including public safety, education, transportation, healthcare, and infrastructure development. These services require financial resources to operate effectively.

Public Employee Compensation: The Largest Expense

One of the most substantial costs borne by local governments is public employee compensation. This category includes salaries, wages, benefits, pensions, healthcare coverage, and other related expenses for government employees. Local governments employ a vast number of individuals to deliver essential services to the community.

Public employee compensation has a significant impact on the budgetary decisions of local governments. Allocating sufficient funds to compensate employees fairly is crucial for attracting and retaining skilled individuals who can effectively serve the community. However, this expense must be managed prudently to avoid creating an unsustainable financial burden.

Importance of Staying Up-to-Date

Understanding the largest expense for most local governments is vital for various stakeholders, including policymakers, government officials, taxpayers, and legal professionals. Staying up-to-date on this topic allows individuals to:

1. Assess Fiscal Responsibility: By understanding the largest expense, policymakers and taxpayers can evaluate whether local governments are managing their financial resources responsibly. This knowledge empowers citizens to hold their elected officials accountable for budgetary decisions.

2. Advocate for Effective Budgeting: Armed with knowledge about the largest expense, individuals can advocate for efficient allocation of resources and improved transparency in government budgeting. This can lead to better financial planning and the prioritization of essential services.

3. Ensure Compliance with Laws: Awareness of the largest expense enables legal professionals to ensure that local governments are complying with relevant laws and regulations. This includes laws related to public employee compensation, such as minimum wage requirements and pension obligations.

4. Identify Potential Issues: Staying up-to-date on the largest expense allows stakeholders to identify potential issues or trends that may impact the financial stability of local governments. Early identification of problems can help prevent financial crises and allow for timely corrective action.

Verifying and Contrasting Information

While this article aims to provide an informative overview of the largest expense for most local governments, it is essential for readers to verify and contrast the information provided. Local government budgets vary across jurisdictions, and factors such as population size, demographics, and economic conditions can influence the largest expense.

Readers are encouraged to consult reliable sources such as government financial reports, academic research, and professional publications in order to gain a comprehensive understanding of this topic. Additionally, comparing information from multiple sources can help identify any discrepancies or biases that may exist.

In conclusion, understanding the largest expense for most local governments is crucial for various stakeholders. By staying up-to-date on this topic, individuals can assess fiscal responsibility, advocate for effective budgeting, ensure compliance with laws, and identify potential issues. However, it is essential to verify and contrast the information provided to gain a comprehensive understanding of this complex subject.