Understanding the Role of a Fiduciary in Case Law: A Comprehensive Analysis

Welcome to this informative article on the role of a fiduciary in case law. In this exploration, we will delve into the intricate world of fiduciary responsibilities, shedding light on their importance and impact within the realm of US law.

Before we begin, it’s important to note that while we strive to provide you with accurate and reliable information, it is crucial to cross-reference with other sources or consult legal advisors for specific advice. With that in mind, let’s embark on our journey to uncover the complexities of the fiduciary role.

📋 Content in this article

1. Introduction to Fiduciary Duty

A fiduciary is an individual or entity that holds a position of trust and confidence, bound by a legal obligation to act in the best interest of another party. This duty requires them to exercise utmost loyalty, good faith, and honesty in their actions. Fiduciaries are entrusted with managing and safeguarding assets on behalf of another person or entity, known as the beneficiary.

2. Types of Fiduciaries

Fiduciaries can take various forms depending on the context in which they operate. Some common examples include:

3. Fiduciary Duties and Standards

The fiduciary’s primary duty is to act solely in the best interest of the beneficiary, setting aside any personal interests or conflicts

Understanding Fiduciary Duties in US Case Law

Understanding the Role of a Fiduciary in Case Law: A Comprehensive Analysis

In the United States legal system, a fiduciary is an individual or entity entrusted with the responsibility to act in the best interests of another party. This legal relationship, known as a fiduciary duty, imposes strict obligations on the fiduciary to act honestly, faithfully, and ethically on behalf of their client or beneficiary. Understanding the role of a fiduciary in case law is crucial for individuals seeking legal representation or engaging in business relationships involving fiduciary duties.

1. What is a Fiduciary Duty?

A fiduciary duty is a legal obligation that requires a fiduciary to put the interests of their client or beneficiary above their own. This duty is characterized by the highest standard of care and loyalty. Fiduciaries must act in good faith, exercise prudence, and avoid conflicts of interest that could compromise their ability to act in the best interests of their client or beneficiary.

2. Types of Fiduciary Relationships:

Fiduciary duties can arise in various contexts. Here are some common examples:

3. Breach of Fiduciary Duty:

When a fiduciary fails to fulfill their obligations or acts in a manner inconsistent with their fiduciary duty, it is considered a breach of fiduciary duty.

Understanding the Five Fiduciary Duties in US Law: A Comprehensive Overview

Understanding the Five Fiduciary Duties in US Law: A Comprehensive Overview

In US law, a fiduciary is a person or entity that is entrusted with the responsibility to act in the best interest of another party. This legal relationship is built on trust and confidence, and it imposes certain obligations on the fiduciary. To fulfill these obligations, a fiduciary must adhere to five fundamental duties that serve as the cornerstone of their role.

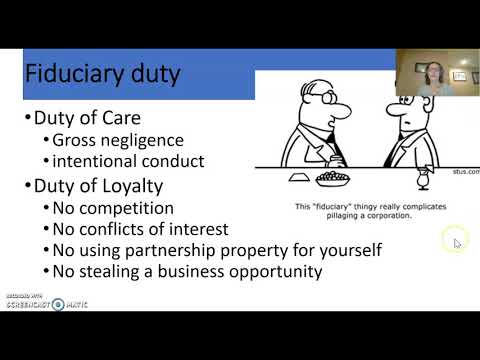

1. Duty of Loyalty:

The duty of loyalty requires a fiduciary to prioritize the interests of their client above their own. This means that the fiduciary must avoid any conflicts of interest that could compromise their ability to act solely in the best interest of their client. For example, a financial advisor who recommends investments based on their own personal gain rather than what is best for their client would be in violation of this duty.

2. Duty of Care:

The duty of care requires a fiduciary to exercise reasonable care, skill, and diligence in carrying out their responsibilities. This duty encompasses a wide range of actions, including conducting thorough research, seeking expert advice when necessary, and making informed decisions based on all available information. For instance, a trustee managing a trust must prudently invest the assets to ensure they grow while minimizing risk.

3. Duty of Confidentiality:

The duty of confidentiality obligates a fiduciary to keep all information concerning their client’s affairs confidential. This duty extends beyond the duration of the fiduciary relationship and remains in effect even after it ends. An attorney, for example, must maintain client confidentiality and cannot disclose privileged information without the client’s consent or unless required by law.

4. Duty of Disclosure:

The duty of disclosure requires a fiduciary to provide their client with all relevant information that could influence their decision-making process. This duty ensures that the client has access to complete and accurate information to make informed decisions.

Title: Understanding the Role of a Fiduciary in Case Law: A Comprehensive Analysis

Introduction:

The role of a fiduciary in US law is pivotal, as it involves the highest duty of care and loyalty to another individual or entity. Fiduciaries are entrusted with managing assets, making decisions, and acting in the best interests of their beneficiaries. This article aims to provide a comprehensive analysis of the role of a fiduciary in case law, emphasizing the importance of staying current on this topic.

Importance of Staying Current on the Role of a Fiduciary:

1. Evolving Legal Landscape: The legal principles governing fiduciary duties are not static. They can change over time through court decisions, legislation, and regulatory developments. Staying current on the role of a fiduciary ensures that individuals and entities can adapt their practices accordingly, avoiding potential legal pitfalls.

2. Compliance and Risk Management: Understanding the nuances of fiduciary law helps individuals and entities fulfill their obligations and responsibilities. By staying current on the role of a fiduciary, one can effectively assess risks, establish robust compliance measures, and mitigate potential liabilities.

3. Protecting Beneficiaries: Fiduciaries owe a duty of loyalty to their beneficiaries, putting the beneficiaries’ interests above their own. Staying current on the role of a fiduciary allows individuals and entities to protect the rights, assets, and well-being of those they serve. It ensures that fiduciaries are aware of any changes in the law that may impact their fiduciary obligations and responsibilities.

4. Avoiding Breach of Fiduciary Duties: Failing to fulfill fiduciary duties can lead to legal consequences, such as lawsuits, financial penalties, and reputational damage. Staying current on the role of a fiduciary helps individuals and entities avoid breaching their obligations, ensuring they act prudently, honestly, and in good faith.