Understanding the Basics: Decoding the 752 Companies Ordinance

Greetings,

📋 Content in this article

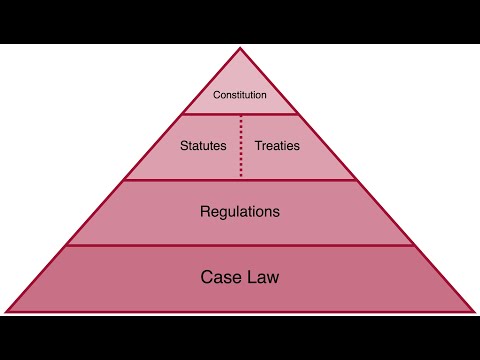

In this article, we will delve into the fundamental concepts and principles behind the 752 Companies Ordinance. This legislation forms the bedrock of corporate governance and regulation in the United States. By understanding the basics of this ordinance, individuals can navigate the intricacies of corporate law with confidence.

To begin, let’s clarify what an “ordinance” is. An ordinance is a law or regulation enacted by a local or regional government authority. In the case of the 752 Companies Ordinance, it specifically focuses on the regulation of companies operating within the United States.

The 752 Companies Ordinance establishes a comprehensive framework for the formation, operation, and dissolution of companies. It sets forth the legal requirements and obligations that companies must adhere to in order to conduct business in a fair and transparent manner.

Here are some key aspects of the 752 Companies Ordinance that are important to understand:

1. Formation of Companies: The ordinance outlines the procedures and requirements for establishing a company. This includes the types of companies that can be formed, such as limited liability companies (LLCs), corporations, and partnerships.

2. Corporate Governance: The ordinance establishes rules and regulations governing how companies should be managed and operated. This includes provisions related to shareholder rights, board of directors’ responsibilities, and corporate decision-making processes.

3. Shareholders’ Rights: The ordinance protects the rights of shareholders by ensuring they have access to relevant information about the company, can participate in decision-making processes, and have a say in major company transactions.

4. Financial Reporting: Companies are required to maintain accurate financial records and provide regular financial statements to shareholders and regulatory authorities. The ordinance sets standards for financial reporting and auditing to promote transparency and accountability.

5. Dissolution and Liquidation: The ordinance also governs the process of winding up and dissolving companies. It outlines the steps to be followed, including settling debts, distributing assets, and terminating legal obligations.

It is worth noting that the 752 Companies Ordinance is not static and may undergo amendments and revisions over time. It is essential for individuals involved in corporate matters to stay updated with any changes to ensure compliance with the law.

In conclusion, the 752 Companies Ordinance is a vital piece of legislation that sets the foundation for corporate governance in the United States. By understanding its basic concepts and provisions, individuals can effectively navigate the legal landscape of company formation, operation, and dissolution.

Remember, seeking professional legal advice is always recommended when dealing with specific legal matters.

Understanding Section 752 of the Companies Ordinance: A Comprehensive Overview

Understanding the Basics: Decoding Section 752 of the Companies Ordinance

Section 752 of the Companies Ordinance is a crucial provision that governs the operation and management of companies in the United States. It is important for business owners, shareholders, and potential investors to have a comprehensive understanding of this section, as it sets out key requirements and obligations that must be complied with.

To assist you in navigating the complexities of Section 752, this article serves as a comprehensive overview, decoding the essential concepts and provisions contained within it.

1. Purpose of Section 752:

Section 752 is designed to regulate the internal affairs of companies and ensure their proper functioning. It establishes the framework for various corporate matters, including corporate governance, record-keeping, shareholder rights, and director duties.

2. Corporate Governance:

Section 752 defines the roles and responsibilities of directors, officers, and shareholders. It outlines the duties of directors to act in the best interests of the company, exercise due care, and avoid conflicts of interest. It also establishes the rights of shareholders to vote on key matters, inspect corporate records, and receive financial information.

3. Record-Keeping Requirements:

Under Section 752, companies are obligated to maintain accurate and up-to-date records. This includes financial statements, shareholder lists, meeting minutes, and other important documents. These records must be kept at the company’s registered office and made available for inspection by shareholders and regulatory authorities.

4. Shareholder Rights:

Section 752 safeguards the rights of shareholders by providing mechanisms for them to participate in important decisions. These decisions may include amendments to the company’s articles of incorporation, mergers or acquisitions, and appointment or removal of directors. Shareholders are typically entitled to vote on these matters in proportion to their shareholding.

5. Director Duties:

Section 752 imposes fiduciary duties on directors, requiring them to act in the best interests of the company and its shareholders. Directors must exercise reasonable care, skill, and diligence in carrying out their duties and avoid conflicts of interest. They are also responsible for making informed decisions and acting in accordance with the company’s articles of incorporation and applicable laws.

6. Compliance and Penalties:

Failure to comply with the provisions of Section 752 may result in legal consequences and penalties. Companies that violate the requirements set out in this section may be subject to fines, civil liability, or even criminal prosecution. It is essential for companies to stay informed about their obligations under Section 752 and ensure compliance to avoid potential legal ramifications.

In conclusion, understanding Section 752 of the Companies Ordinance is vital for anyone involved in the operation and management of a company. This provision lays the foundation for corporate governance, shareholder rights, record-keeping, and director duties. By comprehending the key concepts within this section, businesses can navigate the legal landscape effectively and safeguard their interests.

Understanding Section 751 of the Companies Ordinance: Key Concepts and Implications

Understanding Section 751 of the Companies Ordinance: Key Concepts and Implications

In the realm of corporate law, it is essential for businesses and individuals alike to have a comprehensive understanding of the legal framework that governs their operations. One such important aspect of corporate law in the United States is Section 751 of the Companies Ordinance. This provision encompasses key concepts and implications that can significantly impact businesses and their stakeholders.

To decode the basics of Section 751, it is crucial to start by understanding its purpose and scope. Section 751 is a statutory provision that outlines the treatment of certain assets and liabilities when a partnership interest is transferred. It applies to situations where a partner transfers their interest in a partnership to another party, thereby leading to a potential revaluation of partnership assets and liabilities.

Listed below are some key concepts and implications surrounding Section 751:

1. Hot Assets: Section 751 distinguishes between ordinary income assets and capital assets, commonly referred to as “hot” and “cold” assets, respectively. Hot assets include inventory, unrealized receivables, and depreciation recapture amounts. These assets are subject to different tax treatment upon transfer, potentially resulting in different tax consequences for the transferor and transferee.

2. Ordinary Income: When a partner transfers their interest, any gain or loss attributable to hot assets is treated as ordinary income or loss. This means that such gains or losses are taxed at ordinary income rates, rather than at the lower capital gains rates applicable to cold assets.

3. Allocable Share: Under Section 751, a partner’s allocable share of hot assets is determined based on their share of profits in the partnership. This allocation affects how the gain or loss from the transfer of hot assets is divided among the partners.

4. Step-In-The-Shoes Rule: The step-in-the-shoes rule is another crucial concept under Section 751. It requires the transferee of a partnership interest to assume the transferor’s share of hot assets and liabilities. This rule ensures that the tax consequences associated with the transfer of hot assets are not avoided by simply transferring the partnership interest.

5. Impact on Business Transactions: Understanding Section 751 is vital, as it can significantly impact various business transactions, such as mergers, acquisitions, and transfers of partnership interests. Parties involved in these transactions must carefully consider the potential tax implications and structure their deals accordingly to optimize tax efficiency.

In conclusion, Section 751 of the Companies Ordinance is a critical provision that affects the taxation of certain assets and liabilities upon the transfer of a partnership interest. By grasping the key concepts and implications outlined above, businesses and individuals can navigate these transactions with a clear understanding of their tax consequences. It is always advisable to consult with a qualified tax professional or attorney to ensure compliance with the applicable laws and regulations.

Understanding the New Companies Ordinance: A Comprehensive Guide

Understanding the Basics: Decoding the 752 Companies Ordinance

The 752 Companies Ordinance is a key piece of legislation that governs the formation and operation of companies in the United States. It sets out the legal framework within which companies must operate and comply with various legal requirements. As a potential client, it is crucial to have a thorough understanding of this ordinance to ensure compliance and avoid any legal pitfalls.

Here are some key points to consider when it comes to understanding the basics of the 752 Companies Ordinance:

1. Formation of Companies:

– The 752 Companies Ordinance provides guidelines for the formation of different types of companies, such as corporations and limited liability companies.

– It outlines the necessary steps and requirements for registering a company, including drafting and filing the company’s articles of incorporation or organization.

– Tip: Seek legal advice when drafting these documents to ensure compliance with the ordinance.

2. Corporate Governance:

– The 752 Companies Ordinance establishes rules and regulations for corporate governance. This includes defining the roles and responsibilities of directors, officers, and shareholders.

– It sets out requirements for holding annual meetings, recording minutes, and maintaining proper corporate records.

– Tip: Regularly review and update your company’s corporate governance practices to stay in line with legal requirements.

3. Shareholder Rights and Protections:

– The ordinance safeguards shareholder rights, ensuring that they have access to important information about the company and the ability to participate in decision-making processes.

– It also provides mechanisms for minority shareholders to protect their interests and challenge oppressive actions by majority shareholders.

– Tip: Familiarize yourself with your rights as a shareholder and consult with legal professionals if you believe your rights have been violated.

4. Financial Reporting and Accountability:

– The 752 Companies Ordinance imposes obligations on companies to maintain accurate financial records and prepare annual financial statements.

– It sets out requirements for audits and appointing independent auditors to ensure transparency and accountability.

– Tip: Comply with financial reporting obligations to avoid penalties and maintain the trust of your shareholders and stakeholders.

5. Compliance and Enforcement:

– The ordinance grants regulatory authorities the power to enforce compliance with its provisions.

– It imposes penalties for non-compliance, such as fines and potential criminal liability.

– Tip: Stay informed about changes to the ordinance and consult legal professionals to ensure ongoing compliance with all legal requirements.

Understanding the basics of the 752 Companies Ordinance is crucial for both individuals looking to start a new company and those already operating a business. Compliance with this ordinance is essential to ensure legal protection, maintain good corporate governance practices, and foster trust among shareholders and stakeholders.

Remember, seeking legal advice from experienced professionals is highly recommended to navigate the complexities of the 752 Companies Ordinance effectively.

Understanding the Basics: Decoding the 752 Companies Ordinance

In the ever-evolving world of law, it is crucial for legal practitioners and individuals alike to stay up-to-date with the latest legislative developments. One such significant piece of legislation is the 752 Companies Ordinance. This article aims to provide a basic understanding of this ordinance and emphasize the importance of staying informed on this topic.

What is the 752 Companies Ordinance?

The 752 Companies Ordinance is a legislative framework that governs corporations and related entities in the United States. It sets out the rules and regulations for the formation, operation, governance, and dissolution of these entities. The ordinance aims to ensure transparency, accountability, and fairness within the corporate sector.

Why is it important to stay up-to-date on this topic?

1. Compliance: The 752 Companies Ordinance sets out numerous legal requirements that companies must adhere to. Staying informed about any updates or amendments to the ordinance will help corporations maintain compliance and avoid potential legal pitfalls.

2. Legal Consequences: Failure to comply with the provisions of the 752 Companies Ordinance can result in severe legal consequences, including fines, sanctions, or even criminal liability. Regularly staying updated on this topic will help individuals and businesses mitigate these risks.

3. Corporate Governance: The 752 Companies Ordinance plays a vital role in promoting good corporate governance practices. By staying current with any changes to the ordinance, directors, officers, and shareholders can ensure they are fulfilling their responsibilities and acting in the best interests of the company.

4. Competitive Advantage: Being knowledgeable about the 752 Companies Ordinance can give individuals and businesses a competitive advantage in today’s corporate landscape. Understanding the latest requirements and implementing best practices can enhance corporate reputation and attract potential investors or business partners.

Verifying and Contrasting

While this article aims to provide a basic understanding of the 752 Companies Ordinance, it is essential to verify and contrast the information provided. Laws and regulations can vary by jurisdiction, and it is crucial to consult relevant legal resources, seek professional advice, or refer directly to the ordinance itself.

Furthermore, it is important to note that the interpretation and application of the 752 Companies Ordinance may be subject to judicial decisions, administrative guidance, or amendments. Therefore, regularly checking for updates and consulting legal experts is highly recommended.

Conclusion

Staying up-to-date on the 752 Companies Ordinance is of utmost importance for individuals and businesses involved in the corporate sector. Compliance with the ordinance’s provisions, understanding the legal consequences of non-compliance, promoting good corporate governance, and gaining a competitive advantage are all compelling reasons to stay informed on this topic. However, it is essential to verify and contrast the information provided in this article with reliable sources and seek professional advice when necessary.