Hello and welcome,

In this comprehensive guide, we will delve into the intricacies of understanding impact fees in San Bruno. Impact fees are charges imposed by local governments on new developments to help mitigate the impact that these developments have on public infrastructure and services.

📋 Content in this article

While impact fees vary from city to city, they generally apply to residential, commercial, and industrial developments. They are designed to ensure that the costs associated with new development, such as increased demand for schools, parks, roads, and utilities, are adequately addressed.

To provide a clear understanding of impact fees in San Bruno, we will discuss the following key points:

- The purpose and rationale behind impact fees

- The types of projects and developments that are subject to impact fees

- The process of determining and calculating impact fees

- The legal framework governing impact fees in San Bruno

- The potential benefits and drawbacks of impact fees

By the end of this guide, you will have a solid understanding of impact fees and how they play a crucial role in the development of San Bruno. Let’s get started!

Please note that while this guide provides valuable information, it is always recommended to consult with a legal professional or the appropriate local authorities for specific guidance on impact fees in your area.

Thank you for entrusting us with your legal information needs.

Understanding Impact Fees in San Bruno: A Comprehensive Guide

Understanding Impact Fees in San Bruno: A Comprehensive Guide

Impact fees play a crucial role in real estate development and are an essential component of local government revenue. If you are considering investing in or developing property in San Bruno, it is important to understand what impact fees are and how they can affect your project. This comprehensive guide aims to provide you with the necessary information to navigate the complexities of impact fees in San Bruno.

What are impact fees?

Impact fees are charges levied by local governments on new development projects to fund public infrastructure and services that are needed as a result of the increased demand created by the development. These fees are imposed to ensure that the costs associated with the impacts of growth are borne by those responsible for the growth itself, rather than placing an unfair burden on existing residents and taxpayers.

Types of impact fees

In San Bruno, there are several types of impact fees that may be applicable to your project. Common types include:

It is important to note that the specific impact fees applicable to your project will depend on the type and size of development, so it is crucial to consult with a qualified professional or local authorities for accurate information.

Calculating impact fees

Impact fees are typically calculated based on the projected increase in demand for public infrastructure and services generated by a new development project. This calculation considers factors such as the size of the development, number of units, and the specific impact fee rates set by the local government. The fees are usually paid at the time of building permit issuance, and failure to pay may result in delays or potential legal consequences.

Exemptions and credits

Certain exemptions and credits may be available to reduce or waive impact fees in specific circumstances. For example, affordable housing projects may be eligible for fee reductions or exemptions to encourage their development. Additionally, if a developer agrees to provide certain public amenities or infrastructure improvements as part of their project, they may receive credits towards their impact fees. These exemptions and credits are subject to specific requirements and should be discussed with local authorities.

Appealing impact fees

If you believe that the impact fees imposed on your project are unjust or inaccurate, you have the right to appeal the decision. The appeal process typically involves presenting evidence and arguments to a designated appeals board or commission. It is advisable to seek legal guidance to navigate this process effectively.

Understanding the Impact Service Fee: Key Considerations and Implications

Understanding Impact Fees in San Bruno: A Comprehensive Guide

If you are a resident or business owner in San Bruno, it is important to understand the concept of impact fees and their implications. Impact fees are charges imposed by local governments on new development projects to help mitigate the impact of the development on public infrastructure and services. These fees are often used to fund the construction or improvement of schools, parks, transportation systems, and other public facilities.

Key Considerations

1. Purpose: Impact fees serve as a mechanism for ensuring that new developments contribute their fair share towards the additional demand they place on public services and infrastructure. These fees help local governments maintain adequate public facilities and prevent existing residents from shouldering the entire burden of the costs associated with growth.

2. Legal Basis: Impact fees must be authorized by state law or local ordinance. In San Bruno, impact fees are authorized under the Mitigation Fee Act, which outlines specific requirements and limitations for their imposition.

3. Calculation: Impact fees are typically calculated based on the estimated cost of providing additional public facilities or services necessitated by the development. Factors such as the type of development, square footage, number of units, and the impact on public infrastructure are considered when determining the fee amount.

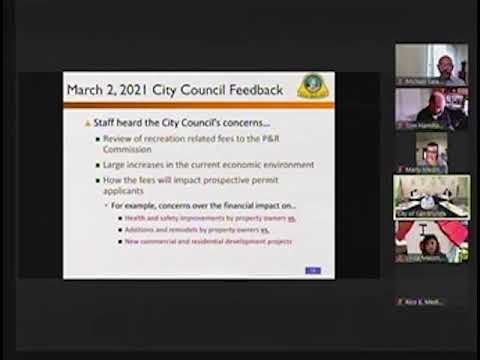

4. Public Process: Local governments are required to engage in a public process before adopting impact fees. This process involves public notices, hearings, and opportunities for interested parties to provide input and feedback on the proposed fees.

5. Exemptions and Credits: Certain developments may be eligible for exemptions or credits that reduce or eliminate the impact fee obligation. For example, affordable housing projects or projects that provide public benefits may qualify for exemptions or reduced fees.

Implications

1. Cost of Development: Impact fees can significantly impact the overall cost of a development project. It is important for developers to carefully consider these fees and factor them into their budget and financial projections.

2. Project Feasibility: The imposition of impact fees can affect the feasibility of a development project, particularly for smaller-scale projects with limited profit margins. Developers should evaluate the potential financial impact of these fees before proceeding with a project.

3. Market Conditions: Impact fees can vary significantly between jurisdictions and can be influenced by market conditions and political factors. Developers should stay informed about the impact fee structure and any changes that may affect their projects.

4. Timing and Payment: Impact fees are usually paid at specific milestones during the development process, such as building permit issuance or certificate of occupancy. Developers should be aware of the timing and payment requirements to avoid delays or penalties.

5. Long-Term Benefits: While impact fees may increase the upfront costs of development, they contribute to the long-term sustainability and quality of life in a community. Well-maintained public facilities and infrastructure can enhance property values and attract future residents and businesses.

In conclusion, understanding the concept of impact fees and their implications is crucial for developers, business owners, and residents in San Bruno. It is recommended to consult with legal professionals or local government authorities to ensure compliance with relevant laws and regulations and to fully understand the specific impact fee requirements in your jurisdiction.

Understanding Impact Fees in Arizona: A Comprehensive Guide

Understanding Impact Fees in Arizona: A Comprehensive Guide

Impact fees are a crucial component of development projects in Arizona. When undertaking a new development, it is essential to understand how impact fees work and how they can impact your project’s budget. This comprehensive guide will provide you with an overview of impact fees in Arizona, helping you make informed decisions and navigate the process more effectively.

What are Impact Fees?

Impact fees are charges imposed by local governments on new development projects to help fund the cost of infrastructure necessary to support the increased demand created by the project. These fees are typically assessed on a per-unit or per-square-foot basis and are intended to ensure that growth pays for itself.

How are Impact Fees Calculated?

The calculation of impact fees varies depending on the local jurisdiction and the type of development project. Generally, impact fees are determined based on the projected impact of the development on public facilities such as roads, parks, schools, and water and sewer systems. This projection is typically based on factors such as the size of the development, the number of units or square footage, and the anticipated demand it will generate.

Understanding the Legal Basis for Impact Fees in Arizona

In Arizona, impact fees are authorized by state law and are subject to specific legal requirements. The Arizona Revised Statutes (A.R.S.) provide the legal framework for impact fees, outlining the powers and limitations of local governments when imposing these fees. It is essential to consult the relevant statutes and any local ordinances to ensure compliance with the law.

The Purpose of Impact Fees

The primary purpose of impact fees is to mitigate the burden that new development places on public infrastructure. By shifting some of the cost to the developers, impact fees aim to ensure that existing residents are not solely responsible for funding new infrastructure necessitated by growth. These fees also help promote smarter growth and encourage developers to consider the long-term impact of their projects.

The Impact Fee Assessment Process

The assessment of impact fees generally involves several steps. First, the local government identifies the specific infrastructure needs resulting from new development. Then, a study is conducted to estimate the costs associated with meeting those needs. This study takes into account factors such as population growth, housing demand, and transportation requirements. Finally, based on the study’s findings, the local government establishes impact fee rates and provides a clear methodology for their calculation.

Challenges and Considerations

While impact fees serve an important purpose in supporting infrastructure development, they can also present challenges for developers. It is crucial to carefully review the impact fee calculation methodology employed by the local government to ensure it is based on accurate data and reasonable assumptions. Additionally, impact fees must meet certain legal standards, including proportionality and nexus requirements, to ensure they are fair and justified.

Understanding Impact Fees in San Bruno: A Comprehensive Guide

As a seasoned attorney in the U.S., I have come to appreciate the importance of staying up-to-date on various legal topics. One such topic that requires careful attention is understanding impact fees, particularly in the city of San Bruno. Impact fees are charges imposed by local governments on developers to help offset the cost of public infrastructure and services necessitated by new developments. These fees can have a significant impact on both developers and the community at large, making it crucial for all parties involved to have a thorough understanding of how they work.

What are Impact Fees?

Impact fees are charges assessed by local governments on developers when they build new residential or commercial developments. The purpose of these fees is to help mitigate the impact of the new development on public infrastructure and services. The funds collected through impact fees are typically used to improve or expand infrastructure such as roads, parks, schools, and utilities, ensuring that the community can accommodate the increased demand caused by new development.

How are Impact Fees Calculated?

The calculation of impact fees is based on several factors, including the type and size of development, the number of new units or square footage being added, and the specific needs of the community. Typically, local governments will conduct studies to determine the anticipated costs associated with the increased demand for public infrastructure and services. These studies take into account factors such as population growth, traffic patterns, school enrollment, and park usage. Based on these studies, local governments establish a fee schedule that outlines the impact fees applicable to different types of developments.

Why is Understanding Impact Fees Important?

It is crucial for developers to have a thorough understanding of impact fees as they can significantly impact the financial viability of a project. Failure to properly account for these fees can result in unexpected costs and delays in obtaining necessary approvals. Additionally, understanding impact fees allows developers to better anticipate and plan for the financial obligations associated with their projects.

On the other hand, the community also benefits from a clear understanding of impact fees. By ensuring that developers pay their fair share towards the cost of infrastructure and services, impact fees help prevent the burden from falling solely on taxpayers. Moreover, understanding how impact fees are calculated and used allows community members to hold local governments accountable for the appropriate allocation of these funds.

Verifying and Contrasting the Content

While this guide provides a comprehensive overview of impact fees in San Bruno, it is important to verify and contrast the information provided. Local regulations and fee schedules can change over time, and it is essential to consult the most up-to-date sources when dealing with impact fees. Developers and community members should refer to the official websites of the city of San Bruno and relevant local government agencies for accurate and current information on impact fees.

In conclusion, understanding impact fees is of utmost importance for both developers and the community in San Bruno. By comprehending how these fees are calculated and used, developers can better plan for their projects, while the community can ensure that new developments contribute their fair share towards public infrastructure and services. However, it is crucial to verify and contrast the information provided in this guide with official sources to ensure accuracy and currency.