Understanding the Current Legal Status of the Student Loan Forgiveness Program

Dear Reader,

Welcome to this informative article on the current legal status of the Student Loan Forgiveness Program in the United States. It is important to note that while we will strive to provide a clear and detailed understanding of this topic, it is always recommended to cross-reference with other sources or consult legal advisors for specific advice.

📋 Content in this article

Now, let us delve into the complex world of student loan forgiveness and explore its current legal landscape.

The Student Loan Forgiveness Program is a federal initiative designed to help borrowers alleviate the burden of their student loans. This program offers various options for loan forgiveness or discharge, depending on specific criteria and circumstances.

1. Public Service Loan Forgiveness (PSLF)

One of the most well-known options is the Public Service Loan Forgiveness (PSLF) program. Under PSLF, borrowers who work full-time for qualifying employers, such as government agencies or non-profit organizations, may be eligible for loan forgiveness after making 120 qualifying payments. However, it is crucial to meet all the program requirements and regularly submit certification forms to ensure eligibility.

2. Income-Driven Repayment (IDR) Plans

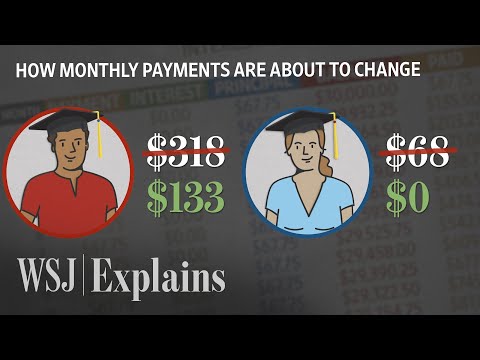

Another avenue for loan forgiveness is through Income-Driven Repayment (IDR) Plans. These plans set your monthly loan payments based on your income and family size. After making a certain number of qualifying payments, typically 20 to 25 years depending on the plan, any remaining balance may be forgiven. It is essential to note that forgiven amounts under IDR plans may be subject to income tax.

3. Closed School Discharge and Other Discharge Options

In certain circumstances, borrowers may be eligible for loan discharge due to the closure of their school, false certification by the school, or other qualifying circumstances such as total and permanent disability. These discharge options provide relief to borrowers in challenging situations and help prevent undue financial hardship.

4

Understanding the Status of Student Loan Forgiveness Lawsuits in the US

Understanding the Current Legal Status of the Student Loan Forgiveness Program

As many individuals in the United States grapple with the burden of student loan debt, exploring options for relief has become increasingly important. One avenue that has gained significant attention is the potential for student loan forgiveness. However, it is crucial to understand the current legal status of the student loan forgiveness program in order to make informed decisions about pursuing this option.

1. The Basics of Student Loan Forgiveness

– Student loan forgiveness refers to the cancellation of all or part of a borrower’s student loan debt.

– This relief can be granted through various programs, such as the Public Service Loan Forgiveness (PSLF) program or income-driven repayment plans.

– The eligibility criteria for each program vary, including factors such as employment type, loan type, and repayment history.

2. The PSLF Program

– The PSLF program is designed to forgive the remaining student loan balance for borrowers who have made 120 qualifying payments while working full-time for a qualifying employer.

– Qualifying employers typically include government organizations, non-profit organizations, and certain types of public service organizations.

– Note: The PSLF program has faced legal challenges in recent years, with some borrowers alleging that they were denied forgiveness despite meeting all requirements. These lawsuits have sparked discussions about the current legal status of the program.

3. Understanding the Legal Challenges

– The lawsuits against the PSLF program primarily revolve around allegations of mismanagement and improper handling of borrower applications.

– Some borrowers claim that their loan servicers provided inaccurate information about program eligibility or failed to process applications appropriately.

– Others argue that they were unfairly denied forgiveness due to misinterpretation of program requirements.

– Note: While these lawsuits highlight individual cases, it is important to note that they do not necessarily reflect the overall viability

Understanding the Supreme Court’s Rulings on Student Loan Forgiveness

Understanding the Current Legal Status of the Student Loan Forgiveness Program

Student loan forgiveness has become an increasingly important issue in recent years, with many borrowers burdened by high levels of debt. The Student Loan Forgiveness Program was established to provide relief for individuals struggling to repay their student loans. However, it is crucial to have a clear understanding of the current legal status of the program to ensure that you can make informed decisions regarding your student loan debt.

1. The Existence of Student Loan Forgiveness Programs:

The concept of student loan forgiveness is not new and has been in place for several decades. The government has recognized the need to provide relief to borrowers who may be facing financial hardship or have made significant contributions to society, such as public service employees or teachers.

This program was established in 2007 and offers loan forgiveness for individuals who work full-time for a qualifying public service organization, such as government agencies or non-profit organizations. To qualify for PSLF, borrowers must make 120 qualifying monthly payments under an eligible repayment plan while working for a qualifying employer.

These repayment plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), allow borrowers to make monthly payments based on their income and family size. After a certain period of time (usually 20 or 25 years), any remaining balance on the loans may be forgiven.

2. The Recent Legal Challenges:

It is important to note that the current legal status of the Student Loan Forgiveness Program has faced several challenges in recent years. These challenges have primarily focused on the interpretation and implementation of the program’s requirements.

One key issue that has arisen is the interpretation of the eligibility criteria for the PSLF

Title: Understanding the Current Legal Status of the Student Loan Forgiveness Program

Introduction:

In recent years, student loan debt has become a significant issue for many individuals in the United States. To help alleviate this burden, various student loan forgiveness programs have been implemented. However, it is crucial to stay updated on the current legal status of these programs, as they are subject to change. This article aims to provide a comprehensive understanding of the student loan forgiveness program while emphasizing the importance of verifying and cross-referencing information.

1. Student Loan Forgiveness Programs:

Student loan forgiveness programs are designed to alleviate the financial burden of student loan debt for qualifying individuals. These programs typically offer partial or complete forgiveness of federal student loans in exchange for fulfilling certain eligibility criteria.

2. Importance of Staying Current:

It is essential to stay informed about the current legal status of student loan forgiveness programs for several reasons:

a) Policy Changes: As policies and laws evolve, eligibility criteria, benefits, and loan forgiveness amounts may change. Tracking these changes will help borrowers determine if they qualify for forgiveness and plan their financial future accordingly.

b) Application Process: Programs often require borrowers to submit applications with specific documentation. Being aware of any updates or changes in application requirements will ensure that borrowers provide accurate information and avoid potential delays or rejections.

c) Loan Servicer Communication: Staying up-to-date ensures that borrowers receive timely communication from their loan servicers regarding important program updates, repayment options, and eligibility status.

3. Verifying Information:

Given the complex nature of student loan forgiveness programs, it is vital to verify and cross-reference the information provided in various sources. Here are some recommended steps:

a) Official Government Sources: Start by visiting official government websites such as the U.S. Department of Education’s website or the Federal Student Aid website. These sources provide reliable and up-to-date information on the current legal status of student loan forgiveness programs.