Greeting:

Hello there! As an experienced attorney based in the United States, I have been enlisted to shed some light on the intriguing topic of whether it is illegal to withhold a payslip in the United Kingdom. Join me as we delve into the legal requirements surrounding this issue and gain a better understanding of the law. Let’s get started!

📋 Content in this article

Understanding Wage Withholding by Employers in the UK: Rights and Remedies

Understanding Wage Withholding by Employers in the UK: Rights and Remedies

When it comes to receiving your wages, it is important to understand your rights as an employee in the UK. Employers have certain legal responsibilities when it comes to paying their employees, which includes providing a payslip that contains specific information. In this article, we will explore whether it is illegal for employers to withhold a payslip in the UK, and the legal requirements surrounding this issue.

Is it Illegal to Withhold a Payslip in the UK?

In short, the answer is no. It is not illegal for an employer to withhold a payslip in the UK. However, employers are legally required to provide employees with a payslip in most cases. The exception to this requirement is for employees who are classified as ‘excluded employees.’ Excluded employees include those who are self-employed, members of the armed forces, or share fishermen.

Understanding the Legal Requirements

For the majority of employees in the UK, employers must provide a payslip that includes certain information. This information includes:

Rights and Remedies for Employees

If an employer fails to provide you with a payslip or includes incorrect information, you have certain rights and remedies available to you. These include:

1. Requesting a payslip: If you have not received a payslip, you have the right to request one from your employer. They must provide you with a payslip within a reasonable timeframe.

2. Challenging incorrect information: If the payslip you receive contains incorrect information, such as incorrect deductions or a miscalculation of your net pay, you should discuss the issue with your employer. They have a duty to correct any errors and provide you with a corrected payslip.

3. Seeking legal advice: If you are unable to resolve the issue with your employer, it may be necessary to seek legal advice. An employment lawyer can assess your case and advise you on the best course of action, which may include filing a claim with an employment tribunal.

In conclusion, while it is not illegal for employers to withhold a payslip in the UK, they are generally required to provide employees with a payslip that contains specific information. If you have not received a payslip or believe that the information provided is incorrect, you have rights and remedies available to address the issue. It is important to be aware of your rights as an employee and take action when necessary to ensure that you are being treated fairly in the workplace.

Understanding Employer Rights: Can Wages be Refused in the UK?

Understanding Employer Rights: Can Wages be Refused in the UK?

When it comes to employment law in the United Kingdom, it is essential for both employers and employees to understand their rights and obligations. One area of concern for employees is the issue of wage refusal. Can employers legally withhold wages from their employees? The answer to this question depends on the circumstances and the specific legal requirements in the UK.

In the UK, employers are generally required to pay their employees the agreed-upon wages for the work they have performed. This obligation is rooted in the employment contract between the employer and employee. The contract may be written or verbal, but it must clearly outline the terms of employment, including details about wages, working hours, and other relevant conditions.

Legal Requirements: Is it Illegal to Withhold a Payslip in the UK?

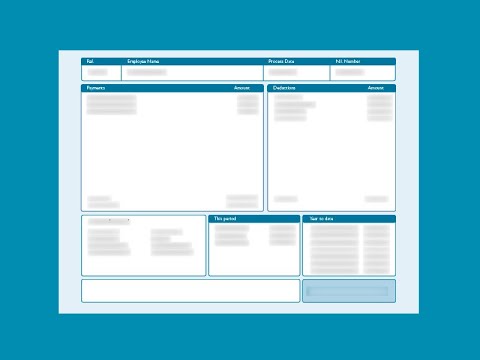

In addition to the requirement to pay wages, employers in the UK are also legally obligated to provide their employees with a payslip. A payslip is a document that outlines the details of an employee’s pay, including their gross pay, deductions, and net pay. It is important for employees to have access to this information for various reasons, such as understanding how their pay is calculated and verifying that they are receiving the correct amount.

Under UK law, employers must give employees a payslip on or before payday. The payslip should include specific information, such as the employee’s name, employer’s name, payment date, gross pay, deductions (e.g., taxes, National Insurance contributions), and net pay. In addition to these mandatory items, employers may also include other details on the payslip, such as overtime hours worked or any bonuses or commissions earned.

Consequences of Withholding Wages or Payslips

If an employer refuses to pay wages or fails to provide a payslip as required by law, they may face legal consequences. Employees have the right to take action against their employers for these violations. There are various avenues available for seeking redress, such as filing a claim with an employment tribunal or seeking legal advice from a solicitor.

Employers found in breach of their obligations may be required to pay their employees the withheld wages, plus any interest or penalties imposed by the court. Additionally, employers may be subject to fines or other sanctions depending on the severity of the violation and the circumstances of the case.

Understanding Unlawful Deductions of Wages in the UK: A Comprehensive Overview

Understanding Unlawful Deductions of Wages in the UK: A Comprehensive Overview

In the United Kingdom, workers are protected by various laws and regulations when it comes to their wages. One important aspect of this protection is the concept of unlawful deductions of wages. This comprehensive overview aims to shed light on what constitutes an unlawful deduction, the legal rights of workers, and the potential remedies available to them.

An unlawful deduction of wages occurs when an employer takes money out of an employee’s pay without a valid reason or without the employee’s consent. This can include deductions for things like breakages, cash shortages, or uniforms, as well as deductions for tax and National Insurance contributions that should not have been made. It is important to note that a deduction can still be unlawful even if the employee owes money to the employer, as there are specific rules governing the recovery of debts from wages.

Providing employees with payslips is a legal requirement in the UK. A payslip must include certain information, such as the gross amount of wages, any deductions made, and the net amount paid to the employee. Employers must provide payslips either physically or electronically, depending on the employee’s preference. Failure to provide a payslip can have serious consequences for employers, including potential penalties.

Withholding payslips is not only unethical but also illegal in the UK. Employees have the right to access accurate and detailed information about their pay, including any deductions made. When an employer fails to provide a payslip, it becomes difficult for employees to verify whether their wages have been unlawfully deducted. This can lead to uncertainty and potential disputes between employers and employees.

Workers in the UK have the right to challenge unlawful deductions of wages through various channels. It is advisable for employees to first raise the issue with their employer and try to resolve it informally. If this does not lead to a satisfactory outcome, they can file a formal complaint with an employment tribunal within three months of the deduction. The tribunal has the power to order the employer to repay the unlawfully deducted wages and potentially award additional compensation.

Reflection: Staying Informed on the Legality of Withholding Payslips in the UK

As a seasoned attorney in the U.S., it is crucial to stay well-informed about legal matters both domestically and internationally. One such topic that requires our attention is the legality of withholding payslips in the UK. This article aims to shed light on the legal requirements surrounding this issue, emphasizing the importance of staying up-to-date on this topic.

Understanding Payslip Legal Requirements in the UK:

In the UK, there are legal obligations that employers must adhere to when it comes to providing payslips to their employees. The law requires employers to provide a payslip to every worker, regardless of their employment status. These payslips must be provided on or before payday and can be provided either in a physical or electronic format.

The Importance of Staying Informed:

Understanding the legal requirements regarding payslips in the UK is crucial for both employers and employees. Employers must ensure that they comply with these obligations to avoid potential legal repercussions. Employees, on the other hand, should be aware of their rights and be able to identify any non-compliance by their employers.

Verifying and Contrasting Content:

While this article aims to provide a general overview of the legal requirements surrounding payslips in the UK, it is always important to verify and contrast the information provided. Laws can change over time, and specific circumstances may alter how these laws are applied. Therefore, it is recommended that readers consult official government sources, legal professionals, or authoritative publications to obtain the most accurate and up-to-date information.

In conclusion, as an attorney, it is crucial to stay informed about legal matters, even those beyond our national borders. The legality of withholding payslips in the UK is one such topic that requires our attention. By understanding the legal requirements and staying up-to-date on this issue, we can provide valuable guidance to our clients and help them navigate potential legal complexities. Remember to always verify and contrast the content of any article to ensure accuracy and currency of information.