Dear Reader,

Welcome to this informative article where we will delve into the current class action lawsuit against Chase Bank for overdraft fees. It is important to note that this article aims to provide you with a comprehensive understanding of the topic, but it is always advisable to cross-reference with other reliable sources or seek guidance from legal professionals.

Now, let’s dive right into the details of this intriguing case.

📋 Content in this article

Overdraft fees have been a point of contention for many bank customers, and Chase Bank has found itself at the center of a class action lawsuit regarding these charges. A class action lawsuit is a legal action filed on behalf of a group of individuals who have suffered similar harm or injury. In this particular case, the plaintiffs allege that Chase Bank has engaged in unfair practices related to their overdraft fees.

Understanding Overdraft Fees:

Before we can grasp the intricacies of the lawsuit, it is important to understand what overdraft fees are. When a bank customer withdraws more money from their account than what is available, the bank may allow the transaction to go through and charge an overdraft fee. These fees act as a penalty for insufficient funds and can vary from bank to bank.

The Allegations Against Chase Bank:

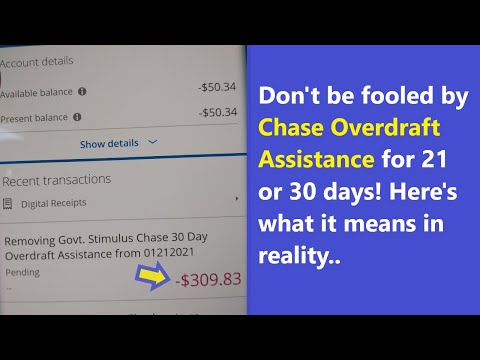

The plaintiffs in the class action lawsuit against Chase Bank claim that the bank has engaged in unfair practices pertaining to their overdraft fees. These alleged practices include manipulating transaction order to maximize the number of overdraft fees charged, failing to adequately disclose fee policies, and imposing excessive fees.

Transaction Order Manipulation:

One of the key allegations against Chase Bank is that they manipulate the order in which transactions are processed. By rearranging the sequence of transactions from highest to lowest amount, rather than chronologically, it is alleged that Chase Bank prioritizes larger transactions. This practice can lead to multiple overdraft fees being charged when smaller transactions are pushed into overdraft status.

Inadequate Fee Disclosure:

Another allegation in the class action lawsuit is that

Understanding Chase’s Policy on Refunding Overdraft Fees

Understanding Chase’s Policy on Refunding Overdraft Fees

Chase Bank, like many other financial institutions, charges overdraft fees when a customer’s account balance falls below zero. These fees can be a significant burden for account holders, especially those who are already facing financial challenges. However, it is important to understand Chase’s policy on refunding overdraft fees and how it relates to the current class action lawsuit against the bank.

1. What are overdraft fees?

When you make a purchase or withdraw money from your account without having enough funds, your account balance goes into the negative. Financial institutions, including Chase, charge a fee for this service, called an overdraft fee. The fee is typically charged per transaction and can range from $25 to $35, depending on the bank and the type of account.

2. Chase’s policy on refunding overdraft fees

Chase Bank has a specific policy regarding the refunding of overdraft fees. According to their policy, they may consider refunding overdraft fees on a case-by-case basis. This means that not all customers will be eligible for a refund, and each situation will be assessed individually.

3. Factors considered for refund eligibility

Chase Bank takes into account several factors when determining whether to refund an overdraft fee. These factors may include the customer’s account history, the frequency of overdrafts, the amount of the fees incurred, and any extenuating circumstances surrounding the overdrawn transaction. It is important to note that Chase has the discretion to decide whether to grant a refund or not.

4. The current class action lawsuit against Chase Bank

There is currently a class action lawsuit pending against Chase Bank regarding its overdraft fee practices. The lawsuit alleges that Chase engaged in unfair and deceptive practices by charging excessive fees and manipulating the order of transactions to maximize overdraft fees.

Exploring the Current Class Action Lawsuit against Chase Bank for Overdraft Fees

Understanding the Current Class Action Lawsuit Against Chase Bank for Overdraft Fees

In recent years, class action lawsuits have become a common way for consumers to seek justice and hold corporations accountable for their actions. One such lawsuit that has gained significant attention is the ongoing class action lawsuit against Chase Bank for their alleged unfair overdraft fee practices. In this article, we will explore the main points of this lawsuit and shed light on its implications.

Background

Chase Bank, one of the largest banks in the United States, is facing a class action lawsuit related to its overdraft fee practices. The lawsuit alleges that Chase Bank has engaged in unfair and deceptive practices by manipulating the order in which it processes customer transactions, leading to excessive overdraft fees being charged to its customers.

The Allegations

The plaintiffs in this class action lawsuit claim that Chase Bank intentionally reorders customer transactions from highest to lowest rather than processing them in chronological order. This practice allegedly increases the likelihood of multiple overdraft fees being incurred by customers. By processing larger transactions first, Chase Bank effectively depletes a customer’s available funds more quickly, resulting in subsequent smaller transactions triggering additional fees. This alleged practice has led to substantial financial losses for many affected customers.

The Impact

The class action lawsuit against Chase Bank has potentially far-reaching implications. If the plaintiffs are successful in proving their case, it could result in significant financial repercussions for the bank. Additionally, it may prompt other financial institutions to reevaluate their own overdraft fee policies and practices. This lawsuit serves as a reminder that businesses must operate with transparency and fairness, especially when dealing with their customers’ finances.

Proving the Case

To succeed in a class action lawsuit against Chase Bank for overdraft fees, the plaintiffs must satisfy several legal requirements. First, they need to demonstrate that there is a “class” of individuals who have been similarly affected by the alleged unfair practices.

Understanding the Current Class Action Lawsuit Against Chase Bank for Overdraft Fees

Introduction:

In recent years, class action lawsuits against major banks have become more prevalent. One such case is the ongoing class action lawsuit against Chase Bank for its overdraft fees. It is imperative to stay informed about this topic, as it not only affects the consumers involved in the lawsuit but also sheds light on the broader issues surrounding overdraft fees in the banking industry. This article aims to provide a comprehensive overview of the current class action lawsuit against Chase Bank, emphasizing the importance of staying updated on this matter.

Background:

Class action lawsuits are legal actions where a group of individuals collectively sues a defendant, typically a company or organization. These lawsuits consolidate numerous individual claims into one lawsuit, allowing individuals who have suffered similar harm to seek compensation as a group. In the case of Chase Bank’s overdraft fees, the lawsuit alleges that the bank engaged in unfair and deceptive practices by charging excessive fees for overdrafts.

Understanding the Lawsuit:

The current class action lawsuit against Chase Bank revolves around its overdraft fees policies. When a customer’s account balance drops below zero, Chase Bank charges an overdraft fee, typically ranging from $34 to $37 per transaction. The lawsuit alleges that these fees are excessive and not proportionate to the actual cost incurred by the bank to cover the overdraft. Additionally, plaintiffs argue that Chase Bank manipulates customer transactions to maximize overdraft fees.

Relevance and Importance:

Staying informed about the current class action lawsuit against Chase Bank is crucial for several reasons. Firstly, if you are a Chase Bank customer who has been charged overdraft fees, you may be eligible to join the class action lawsuit and seek compensation. Being aware of your rights and options is essential in such situations.

Secondly, this case highlights broader issues surrounding overdraft fees in the banking industry. Many consumers are unaware of the actual costs associated with overdrafts and the potential for banks to exploit these fees.