Hello and welcome!

In this article, we will delve into the intricate world of government revenue from petrol. We will explore the various factors that contribute to the government’s income in this area and provide you with a comprehensive analysis of the topic.

📋 Content in this article

Please note that it is important to approach this subject with an open mind and a willingness to learn. While we aim to provide you with accurate information, it is essential to consult official sources and seek professional advice for any specific legal or financial matters.

Now, let’s dive into the details of understanding the government’s revenue from petrol.

Understanding the Tax Revenue Generated by Oil Companies: An In-Depth Analysis

Understanding the Government’s Revenue from Petrol: A Comprehensive Analysis

In today’s global economy, petrol plays a significant role in driving various sectors and supporting economic growth. As such, it is essential to understand the revenue generated by petrol sales and how it contributes to government revenue. This article aims to provide an in-depth analysis of this topic, shedding light on the key concepts and factors that influence the government’s revenue from petrol.

1. Excise Taxes:

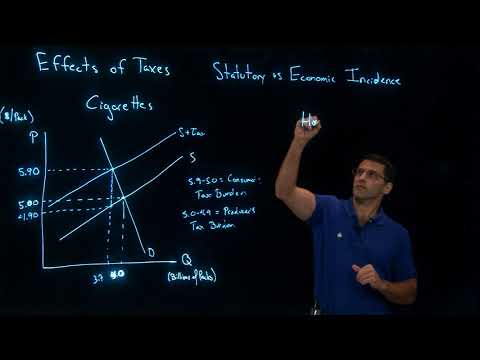

One of the primary sources of government revenue from petrol is through excise taxes. Excise taxes are imposed on the sale or use of specific goods, such as petrol. These taxes are typically levied on a per-gallon basis or as a percentage of the fuel’s price. The revenue generated from these taxes is then used to fund various government programs and initiatives.

2. Sales Taxes:

In addition to excise taxes, governments also collect revenue from petrol sales through sales taxes. These taxes are imposed at the point of purchase and are typically a percentage of the total sale price. The revenue generated from sales taxes is generally used to fund a wide range of public services, including infrastructure development, education, and healthcare.

3. Tax Incentives:

Governments often provide tax incentives to encourage certain behaviors or promote economic growth. In the context of petrol, tax incentives are sometimes offered to oil companies or consumers to reduce the overall tax burden. These incentives can include tax credits, exemptions, or reduced tax rates. While tax incentives may reduce immediate government revenue, they can stimulate economic activity and lead to long-term benefits.

4. Price Fluctuations:

The price of petrol is subject to constant fluctuations due to various factors such as global supply and demand, geopolitical events, and natural disasters. These price fluctuations can significantly impact government revenue from petrol. When prices are high, the revenue generated from taxes and sales can increase. Conversely, during periods of low prices, revenue may decrease, affecting government budgets and spending.

5. Consumption Patterns:

Understanding consumption patterns is crucial in analyzing government revenue from petrol. Factors such as population size, urbanization, and transportation infrastructure affect how much petrol is consumed within a country. Countries with higher levels of car ownership and reliance on petrol for transportation are likely to generate more revenue from petrol sales.

6. Government Policies:

Government policies also play a crucial role in determining the revenue generated from petrol. Policies related to taxation, subsidies, and regulation can impact the overall revenue and profitability of oil companies, which in turn affects the government’s tax revenue. Changes in policies can have far-reaching consequences, influencing both the industry and government revenue.

In conclusion, understanding the government’s revenue from petrol is essential for comprehending the broader economic landscape and the role of petrol in supporting government programs and services. The concepts discussed in this article provide a foundation for analyzing the various factors that influence government revenue from petrol. By examining factors such as excise taxes, sales taxes, tax incentives, price fluctuations, consumption patterns, and government policies, one can gain a comprehensive understanding of this complex topic.

Understanding the Three Main Sources of Government Revenue: Explained in Detail

Understanding the Government’s Revenue from Petrol: A Comprehensive Analysis

In this article, we will delve into the concept of understanding the government’s revenue from petrol in the United States. It is important to have a clear understanding of this topic, as petrol plays a significant role in the country’s economy and is a major source of government revenue. By examining this topic in detail, we can gain insights into the three main sources of government revenue and how they relate to the revenue generated from petrol.

The Three Main Sources of Government Revenue

1. Taxes: Taxes are a primary source of government revenue and are levied on various goods, services, and activities. In the case of petrol, taxes are imposed on each gallon sold. These taxes include federal excise taxes, state sales taxes, and additional local taxes. The rates vary across jurisdictions, with the federal tax being fixed per gallon and state and local taxes being percentage-based.

2. Fees and Permits: Governments also generate revenue from fees and permits associated with petrol-related activities. For example, oil companies may be required to obtain permits for drilling or transportation, and these permits often come with associated fees. Additionally, licenses and certifications required for operating petrol stations or transporting petroleum products also contribute to the government’s revenue.

3. Severance Royalties: Another significant source of revenue for the government is through severance royalties. These royalties are collected from oil and gas companies for extracting non-renewable resources such as crude oil or natural gas. The rates for severance royalties can vary depending on factors such as the volume extracted, market prices, and specific agreements between the government and the industry players.

Government Revenue from Petrol

Petrol is a crucial commodity in the U.S., with millions of gallons sold each day. This high consumption makes it a key revenue generator for the government. The revenue from petrol primarily comes from the taxes imposed on its sale. The federal excise tax on petrol is currently set at a fixed rate per gallon, while state and local taxes vary across jurisdictions. These taxes are often used to fund infrastructure projects, maintain transportation systems, and support environmental initiatives.

It is worth noting that the government’s revenue from petrol can fluctuate depending on several factors, including changes in consumption patterns, fluctuations in oil prices, and shifts in government tax policies. These factors can impact the overall revenue generated and can have broader implications for the economy.

In conclusion, understanding the government’s revenue from petrol is critical for gaining insights into the three main sources of government revenue. Taxes, fees and permits, and severance royalties collectively contribute to the government’s overall revenue. Petrol, being a significant part of the economy, plays a crucial role in generating revenue for the government through taxes. By comprehending these concepts, individuals can better grasp the intricacies of government finance and its relationship with petrol.

Understanding the Four Sources of Federal Revenue in the United States

Understanding the Government’s Revenue from Petrol: A Comprehensive Analysis

In the United States, the federal government relies on various sources of revenue to fund its operations and provide essential services to its citizens. One significant source of revenue for the government is the taxation of petrol, which plays a crucial role in generating funds for vital public programs and infrastructure development.

To gain a comprehensive understanding of the government’s revenue from petrol, it is essential to examine four key sources of federal revenue in the United States:

1. Excise Taxes: Excise taxes are a type of indirect tax imposed on specific goods or services, including petrol. The federal government imposes excise taxes on every gallon of petrol sold, which contributes significantly to its revenue. These taxes are levied at the point of sale or distribution and are included in the price paid by consumers at the gas pump. The revenue generated from excise taxes on petrol is primarily used to fund transportation infrastructure projects, such as road and bridge maintenance, construction, and public transportation initiatives.

2. Corporate Taxes: Corporations involved in the production, refining, and distribution of petrol are subject to federal corporate income taxes. These taxes are levied on the profits earned by these companies from their petrol-related activities. The revenue generated from corporate taxes on petrol companies contributes to the overall federal revenue and is used to fund various government programs and initiatives.

3. Import/Export Duties: The federal government imposes import and export duties on petrol products brought into or taken out of the United States. These duties are typically calculated based on the value or quantity of the petrol products being imported or exported. Revenue generated from import and export duties on petrol adds to the federal government’s overall revenue and can be used for various purposes, including funding national security initiatives and international trade programs.

4. Royalties: The federal government also collects royalties from companies that extract oil and natural gas from federal lands and waters. These royalties are a form of payment made by companies to the government for the right to extract and profit from these natural resources. The revenue generated from royalties on petrol extraction contributes to the federal government’s overall revenue and can be allocated to various programs, including environmental conservation and maintenance of federal lands.

It is important to note that the revenue generated from petrol-related sources is not solely dedicated to funding petrol-related initiatives. Instead, it contributes to the overall federal revenue pool, which is utilized for a wide range of programs and services that benefit the nation as a whole.

Understanding the government’s revenue from petrol provides insight into the financial mechanisms behind the funding of important public projects and initiatives. By comprehending the four sources of federal revenue related to petrol, individuals can better grasp the broader implications of petrol taxation and its role in sustaining the country’s infrastructure and public programs.

Understanding the Government’s Revenue from Petrol: A Comprehensive Analysis

As citizens, it is crucial for us to stay informed and aware of the various ways in which our government generates revenue. One significant source of revenue for the government is through the taxation of petrol. Being aware of how this process works and understanding the factors that influence government revenue from petrol is important for several reasons.

Firstly, understanding the government’s revenue from petrol allows us to have a clearer picture of how our tax dollars are being used. By comprehending the amount of revenue generated from petrol taxation, we can gain insight into the funding available for various public projects and initiatives. This knowledge empowers us to hold our elected officials accountable for their decisions regarding the allocation of these funds.

Secondly, staying informed about the government’s revenue from petrol enables us to engage in meaningful discussions and debates about public policies. For example, when discussions arise about increasing or decreasing petrol taxes, having a solid understanding of the impact on government revenue allows us to contribute to these conversations with informed opinions and arguments. It promotes a more well-rounded and constructive dialogue among citizens and policymakers.

Furthermore, being knowledgeable about the government’s revenue from petrol helps us make informed decisions as consumers. Petrol prices are influenced by various factors, including taxes imposed by the government. By understanding how much of the cost of petrol is due to taxation, we can evaluate whether alternative modes of transportation or energy sources would be more financially advantageous for us. This understanding also allows us to plan our personal budgets more effectively.

It is crucial, however, to emphasize the importance of verifying and contrasting the content of any articles or information sources on this topic. Government revenue from petrol can vary depending on numerous factors such as changes in tax rates, fluctuations in fuel prices, and shifts in consumer behavior. It is recommended to consult multiple reputable sources and cross-reference the information provided before forming conclusions or making decisions based on the revenue figures.

In conclusion, staying up-to-date and understanding the government’s revenue from petrol is of significant importance. It equips us as citizens to have a clearer understanding of how our tax dollars are utilized, enables us to engage in meaningful discussions and debates, and allows us to make informed decisions as consumers. Nevertheless, it is essential to verify and contrast the content of any information sources to ensure accuracy and reliability.