If you have recently inherited funds from a loved one, it is important to understand the legal process of receiving and managing those funds in the United States. Inheriting funds can be a complicated and emotional experience, but with the right knowledge and guidance, you can ensure that the process is smooth and effective.

This article will provide you with a step-by-step guide on how to legally and effectively receive inherited funds in the United States. From understanding the role of probate court to managing taxes on inherited funds, we will cover everything you need to know to make the most of your inheritance. So, whether you have already received your inheritance or are preparing to do so, read on to learn about the legal and financial considerations you should be aware of.

Guidance on Transferring Inheritance Funds to the United States

Transferring inheritance funds from abroad to the United States can be a complex process. It is important to understand the legal requirements and regulations involved to ensure a smooth transfer of funds.

📋 Content in this article

Legal requirements:

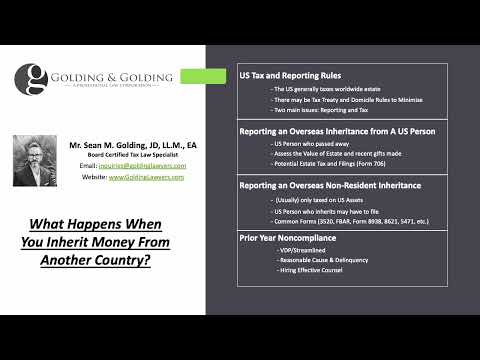

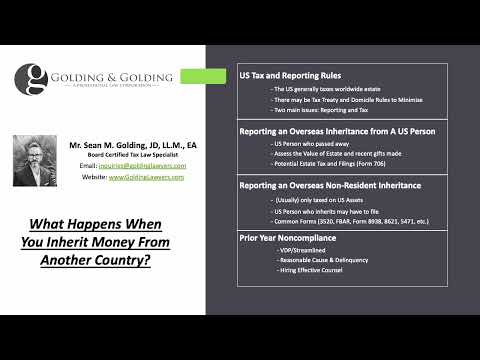

Firstly, it is important to determine if the inheritance funds are subject to U.S. taxes. Inheritance funds may be subject to estate tax or gift tax if the value of the estate exceeds certain thresholds. It is recommended to consult with a tax professional to determine the tax implications of the inheritance funds.

Secondly, it is important to ensure that the inheritance funds are transferred through legal channels. This may involve obtaining the necessary documentation and approvals from the country of origin. It is recommended to consult with a legal professional to ensure compliance with all applicable laws and regulations.

Transferring funds:

There are several options for transferring inheritance funds to the United States. One option is to use an international wire transfer service provided by banks or other financial institutions. It is important to ensure that the transfer is made in U.S. dollars and that all necessary information, such as the recipient’s name and account number, is provided accurately.

Another option is to use a foreign currency exchange service to convert the inheritance funds into U.S. dollars before transferring them to a U.S. bank account. This option may offer more favorable exchange rates, but it is important to ensure that the exchange service is reputable and trustworthy.

Conclusion:

Transferring inheritance funds to the United States can be a complicated process, but with proper planning and guidance, it can be done smoothly. It is important to consult with legal and tax professionals to ensure compliance with all applicable laws and regulations, and to choose a reputable financial institution or exchange service for transferring the funds.

- Example: John inherited $500,000 from his late father’s estate in Canada. He consulted with a tax professional to determine the tax implications of the inheritance funds and with a legal professional to ensure compliance with all applicable laws and regulations. He decided to use an international wire transfer service to transfer the funds to his U.S. bank account.

Maximizing Your Inheritance: A Guide to Efficiently Depositing Inherited Funds

When you inherit funds from a loved one, it can be an emotional and overwhelming experience. However, it is important to make smart decisions to ensure that you are maximizing your inheritance. One of the first steps is to efficiently deposit the funds.

Consider Your Options

There are several options available when it comes to depositing inherited funds. One option is to deposit the funds into a checking account. This is a good choice if you need immediate access to the funds. Another option is to deposit the funds into a savings account, which can earn you interest over time. You may also consider opening a brokerage account to invest the funds in stocks, bonds, and other securities.

Understand the Tax Implications

Before depositing your inherited funds, it is important to understand the tax implications. Inherited funds are generally not subject to income tax, but they may be subject to estate tax. If the estate is large enough to require payment of estate tax, the tax will be paid by the estate before the funds are distributed to the heirs.

Consult with Professionals

If you are unsure about how to best deposit your inherited funds, it may be beneficial to consult with a financial advisor or tax professional. They can provide guidance on the best options for your specific situation and help you make informed decisions.

Example:

For example, if you inherit $100,000 from a loved one, you may choose to deposit $50,000 into a checking account for immediate access and $50,000 into a brokerage account for long-term growth. By diversifying your deposits, you can maximize the potential benefits of your inheritance.

Conclusion

Depositing inherited funds can be a complex process, but with careful consideration and the right guidance, you can make the most of your inheritance.

Remember to consider your options, understand the tax implications, and consult with professionals to make informed decisions.

Inheriting Money: Understanding the Rules and Regulations

When a loved one passes away, they may leave behind a sum of money or other assets for their heirs to inherit. However, inheriting money is not always a straightforward process. There are rules and regulations that must be followed to ensure that the inheritance is distributed properly.

Intestate Succession:

One important factor to consider is whether or not the deceased person had a will. If they did not, then their estate will be distributed according to the state’s laws of intestate succession. This means that the state will determine who the heirs are and how the estate will be divided.

Probate:

Another important consideration is whether or not the estate is subject to probate. Probate is the legal process of administering the estate of a deceased person. It involves proving that the will is valid, identifying and inventorying the deceased person’s property, paying debts and taxes, and distributing the remaining property to the rightful heirs.

Taxes:

Inheriting money may also have tax implications. Depending on the size of the estate and the state in which the deceased person lived, the estate may be subject to state and federal estate taxes.

Trusts:

Sometimes, a deceased person may have set up a trust to manage their assets after they pass away. If you are named as a beneficiary of a trust, the trust’s rules and regulations will determine how and when you receive the inheritance.

Conclusion:

Overall, inheriting money can be a complex process. It is important to understand and follow the rules and regulations surrounding the inheritance to ensure that it is distributed properly. If you have questions about inheriting money, it is recommended that you consult with an experienced estate planning attorney.

Example:

For example, if your grandmother passed away without a will, her estate will be subject to the state’s laws of intestate succession. This means that her property will be distributed to her closest relatives, such as her children or grandchildren, in a specific order determined by state law. If you are unsure about your rights as an heir, it is important to consult with an attorney who can help you understand the rules and regulations surrounding the inheritance.

- Intestate Succession: When a person dies without a will, their assets are distributed according to the state’s laws of intestacy.

- Probate: Probate is the legal process of administering the estate of a deceased person.

- Taxes: Inheriting money may have tax implications, including state and federal estate taxes.

- Trusts: A trust may be established to manage a deceased person’s assets after they pass away.

Maximizing Inheritance Distribution: A Comprehensive Legal Guide

When a loved one passes away, their assets and property are typically distributed through inheritance. However, without careful planning and consideration, the distribution of inheritance can be complicated and may not reflect the wishes of the deceased. To help ensure that your loved one’s estate is distributed fairly and efficiently, it is important to understand the legal process and take steps to maximize inheritance distribution.

Understand the Probate Process

The probate process is the legal process in which a deceased person’s assets are distributed to their heirs and beneficiaries. In order to begin the probate process, the executor of the estate must file a petition with the court. Once the court approves the petition, the executor can begin collecting and valuing assets, paying debts and taxes, and distributing the remaining assets to beneficiaries.

Identify and Value Assets

To ensure that all assets are accounted for and properly distributed, it is important to identify and value all of the deceased person’s assets. This may include bank accounts, real estate, investments, and personal property. Once all assets have been identified, their values must be determined in order to properly distribute them to beneficiaries.

Create a Will or Trust

One of the best ways to maximize inheritance distribution is to create a will or trust. A will is a legal document that outlines how a person’s assets should be distributed after their death. A trust is a legal entity that holds assets for the benefit of designated beneficiaries. Both a will and a trust can help ensure that assets are distributed according to the wishes of the deceased.

Consider Tax Implications

Another important consideration when maximizing inheritance distribution is tax implications. Inheritance tax laws vary by state, and it is important to understand how they may affect your loved one’s estate. Working with a tax professional can help ensure that all tax obligations are properly addressed, and that beneficiaries receive the maximum possible inheritance.

Consult with a Probate Attorney

The probate process can be complex and confusing, and it is important to have the guidance of a knowledgeable probate attorney. An attorney can help ensure that all legal requirements are met, that assets are properly valued and distributed, and that any disputes are resolved in a timely and fair manner.

Example:

For example, let’s say your father passed away and left behind a large estate. Without a will or trust, his assets may be distributed arbitrarily and may not reflect his true wishes. By working with a probate attorney to create a will or trust, you can help ensure that your father’s assets are distributed according to his wishes and that his legacy is preserved for future generations.

Conclusion

Maximizing inheritance distribution requires careful planning, consideration, and legal guidance. By understanding the probate process, identifying and valuing assets, creating a will or trust, considering tax implications, and consulting with a probate attorney, you can help ensure that your loved one’s estate is distributed fairly and efficiently.

Thank you for taking the time to read this article on How to Legally and Effectively Receive Inherited Funds in the United States. We hope that the information presented has been helpful in understanding the legal and practical aspects of receiving inherited funds. Remember to seek professional legal advice to ensure that your rights are protected throughout the process. If you have any further questions or comments, please feel free to leave them below. Goodbye and best of luck in your endeavors!