Hello, fellow readers! Today, we are here to explore the intriguing realm of building insurance and unravel its legal obligations. Whether you are a homeowner, a landlord, or a commercial property owner, understanding building insurance is essential to protect your investment and mitigate potential risks. So, let’s dive right in and shed some light on this important topic.

What is Building Insurance?

Building insurance, also known as property insurance or homeowner’s insurance, is a financial product that provides coverage for physical structures against various perils. These perils may include fire, theft, vandalism, natural disasters like hurricanes or earthquakes, and other unforeseen events that could damage your property.

📋 Content in this article

Legal Obligations for Building Insurance

While building insurance is not required by law in most U.S. states, it is highly recommended and often a prerequisite for obtaining a mortgage loan. Lenders typically require borrowers to have adequate building insurance to safeguard their investment. If you fail to maintain insurance coverage as stipulated in your mortgage agreement, it could result in default and potential foreclosure.

Furthermore, even if you own your property outright without a mortgage, it is wise to have building insurance. This insurance protects your financial interests and helps ensure that you can rebuild or repair your property in the event of damage or destruction.

Types of Building Insurance Coverage

Building insurance policies typically offer different levels of coverage. Here are some common types:

1. Basic Coverage: This type of coverage provides protection against specific named perils stated in the policy. It may include fire, lightning, explosion, theft, and certain natural disasters.

2. All-Risk Coverage: This coverage offers protection against all risks unless specifically excluded in the policy. It generally provides broader coverage but may come at a higher cost.

3. Extended Replacement Cost Coverage: With this coverage, the policy will pay for rebuilding or repairing your property, even if the cost exceeds the insured amount specified in the policy.

4. Actual Cash Value Coverage: This type of coverage takes depreciation into account when determining the payout for a covered loss. The payout is based on the property’s current market value, accounting for wear and tear.

Additional Considerations

When obtaining building insurance, it is crucial to accurately assess the value of your property and its contents. Work with your insurer to determine the appropriate coverage limits, taking into account factors such as construction costs, market value, and replacement value.

It is also important to review your policy regularly to ensure it aligns with your current needs. Changes in property value, renovations, or acquiring new assets may require adjustments to your coverage.

In case of a claim, promptly notify your insurer and provide all necessary documentation to support your claim. Failure to comply with policy requirements or provide accurate information could result in a denial of coverage.

Final Remarks

Building insurance plays a vital role in protecting your property and financial well-being. While it may not be legally mandated in most states, it is a wise investment to safeguard against potential risks and unforeseen events. Remember, each insurance policy may vary, so carefully review the terms, coverage types, and exclusions before making a decision.

Now that you have a clearer understanding of building insurance and its legal obligations, you can make informed choices to protect your property and peace of mind. Stay informed and stay protected!

Understanding the Legal Obligations of Insurance: A Comprehensive Guide

Understanding the Legal Obligations of Building Insurance: Do You Need It?

When it comes to protecting your property, having the right insurance coverage is crucial. Building insurance is a specific type of insurance that focuses on safeguarding your building and its contents against various risks. In this comprehensive guide, we will explore the legal obligations associated with building insurance and help you determine if you need it.

1. Understanding Building Insurance:

Building insurance provides financial protection in the event of damage to a building or its contents. It typically covers risks such as fire, theft, vandalism, and natural disasters. The specific coverage may vary depending on the policy and insurer.

2. Legal Obligations:

While building insurance is not mandatory under federal law, it may be required by other entities such as lenders or local regulations. For example:

3. Protection for Property Owners:

Even if you are not legally obligated to have building insurance, it is still highly recommended. Without proper coverage, you could face significant financial burdens if your property suffers damage or loss. Building insurance provides the following benefits:

4. Evaluating Your Need for Building Insurance:

Determining whether you need building insurance depends on various factors, including:

In conclusion, building insurance plays a vital role in protecting your property and minimizing financial risks. While it may not be legally required in all cases, it is strongly recommended for property owners. Understanding your legal obligations and evaluating your specific needs will help you make an informed decision regarding building insurance.

Understanding the Importance of Liability Insurance: A Comprehensive Overview

Understanding the Legal Obligations of Building Insurance: Do You Need It?

Building insurance is an important aspect of protecting your property and ensuring financial security. As a property owner, it is essential to understand the legal obligations surrounding building insurance and determine whether it is necessary for your specific situation.

Here are some key points to consider:

- What is building insurance?

- Legal obligations

- If you have a mortgage on your property, your lender may require you to maintain building insurance as part of the loan agreement.

- If you are a landlord, your state or local laws might mandate that you carry building insurance to protect your tenants and provide compensation for damages that may occur during their tenancy.

- If you are a member of a homeowners’ association (HOA) or a condominium association, check the governing documents as they often require building insurance for the entire community to ensure collective protection.

- Benefits of building insurance

- Financial protection: Building insurance safeguards your investment by providing funds to repair or rebuild the structure in case of covered damages.

- Liability coverage: Building insurance may also include liability coverage, which protects you financially if someone were to get injured on your property and hold you responsible.

- Peace of mind: Knowing that your property is protected can provide peace of mind, allowing you to focus on other aspects of property ownership.

- Considerations when selecting building insurance

- Coverage limits: Ensure that the insurance policy offers adequate coverage to rebuild your property in case of a total loss.

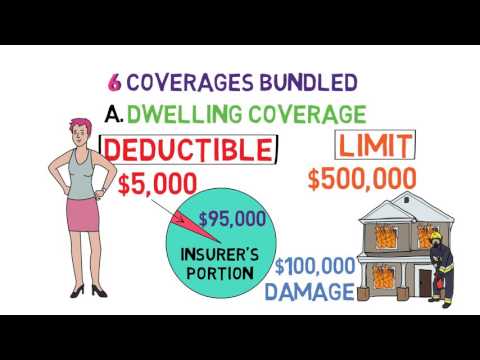

- Deductibles: Understand the deductible amount you would be responsible for paying out of pocket before the insurance coverage kicks in.

- Exclusions: Review the policy’s exclusions to determine what types of damages may not be covered.

- Premiums: Compare premiums from different insurers and consider factors such as the insurer’s reputation, customer service, and financial stability.

- Additional coverage: Evaluate whether you need additional coverage for specific risks that may not be covered under a standard building insurance policy, such as floods or earthquakes.

- The importance of consulting with a professional

Building insurance, also known as property insurance, is a type of insurance coverage that protects the physical structure of a building against damages caused by disasters or other covered events. This includes damages caused by fire, storms, vandalism, or theft.

In many cases, building insurance is not legally required by federal law. However, certain circumstances may necessitate the need for building insurance. For instance:

Building insurance provides numerous benefits:

When choosing building insurance, consider the following:

Given the complexities of building insurance and the potential legal obligations involved, it is advisable to consult with an insurance professional or an attorney who specializes in property law. They can provide guidance tailored to your specific needs and ensure that you comply with any legal requirements.

Understanding your legal obligations regarding building insurance is crucial to protect your property and avoid potential financial hardships. By comprehending the benefits and considerations associated with building insurance, you can make informed decisions to safeguard your investment and provide peace of mind.

Understanding the Duties and Obligations of Insurance Companies: A Comprehensive Guide

Understanding the Legal Obligations of Building Insurance: Do You Need It?

Building insurance is a type of insurance that provides coverage for property owners against various risks and damages to their buildings. It is important to understand the legal obligations associated with building insurance in order to make informed decisions about whether or not you need it. This comprehensive guide aims to provide you with a clear understanding of the duties and obligations of insurance companies in relation to building insurance.

1. What is building insurance?

Building insurance, also known as property insurance, is a type of coverage that protects property owners against financial losses resulting from damage to their buildings. This can include damage caused by natural disasters, accidents, theft, vandalism, or fire. Building insurance typically covers the structure of the building itself, as well as any fixtures, fittings, and permanent improvements.

2. Is building insurance legally required?

While building insurance is not legally required in most jurisdictions, it is often a contractual requirement imposed by mortgage lenders. Lenders want to ensure that their investment is protected in the event of damage to the property. As a result, they may require borrowers to obtain and maintain adequate building insurance coverage throughout the term of the mortgage.

3. Duties and obligations of insurance companies

Insurance companies have certain duties and obligations when it comes to providing building insurance coverage. These include:

a) Duty of good faith: Insurance companies have a duty to act in good faith when dealing with policyholders. This means they must handle claims promptly, fairly, and honestly.

b) Duty to investigate claims: When a policyholder submits a claim for damages, insurance companies have a duty to reasonably investigate the claim. This may involve conducting inspections, gathering evidence, and consulting with experts.

c) Duty to pay legitimate claims: If a claim is found to be legitimate and covered by the policy, insurance companies have a duty to pay the claim promptly and accurately. They should not unreasonably deny or delay payment.

d) Duty to defend: In certain situations, insurance companies have a duty to defend policyholders against legal actions arising from covered events. This may include providing legal representation and covering associated legal costs.

4. Exclusions and limitations

It is important to note that building insurance policies often contain exclusions and limitations. These are specific situations or events that are not covered by the policy. Common exclusions may include damage caused by wear and tear, intentional acts, acts of war, or certain natural disasters. It is crucial to carefully review the policy terms and conditions to understand what is covered and what is not.

5. Importance of accurate disclosure

When applying for building insurance, it is essential to provide accurate and complete information about the property. Failure to disclose relevant facts, such as previous damage or hazardous materials, may result in a denial of coverage or a reduction in the amount of compensation.

In conclusion, understanding the legal obligations of insurance companies in relation to building insurance is crucial for property owners. Building insurance provides financial protection against various risks and damages, and insurance companies have duties to act in good faith, investigate claims, pay legitimate claims promptly, and sometimes defend policyholders. It is important to review policy terms, be aware of exclusions and limitations, and provide accurate information when applying for coverage.

Understanding the Legal Obligations of Building Insurance: Do You Need It?

Introduction:

In today’s complex legal landscape, it is crucial for individuals and businesses alike to understand their legal obligations, especially when it comes to building insurance. Building insurance is a type of coverage that protects property owners from potential financial losses in the event of damage or destruction to their buildings. This article aims to provide an overview of the legal obligations associated with building insurance and the importance of staying informed and up-to-date on this topic.

Legal Obligations:

1. Compliance with Local Laws and Regulations:

Building insurance requirements can vary depending on your jurisdiction and the type of property you own. It is essential to be aware of the specific laws and regulations governing building insurance in your area. Local authorities may require certain types or levels of coverage, such as liability insurance or coverage for specific hazards like earthquakes or floods.

2. Contractual Obligations:

If you have a mortgage or loan on your property, your lender may require you to maintain building insurance as a condition of the loan. Additionally, if you are a tenant, your lease agreement may stipulate that you obtain building insurance for the property you occupy. It is crucial to review and understand any contractual obligations related to building insurance to ensure compliance and protect your interests.

3. Duty of Care:

As a property owner, you have a legal duty of care towards individuals who enter your premises. This duty means you must take reasonable steps to ensure the safety and security of your building. Building insurance plays a crucial role in fulfilling this duty by providing coverage for potential liabilities arising from accidents or injuries that occur on your property.

The Importance of Staying Up-to-Date:

Understanding the legal obligations of building insurance is not a one-time task but an ongoing responsibility. Laws and regulations regarding building insurance can change over time, and new court decisions may impact the interpretation and application of these laws. Staying up-to-date on these developments is crucial for several reasons:

1. Compliance:

Failing to comply with the latest legal requirements can result in severe consequences, including fines, penalties, or even the invalidation of your insurance coverage. By staying informed, you can ensure that your building insurance remains in compliance with the law and meets the necessary standards.

2. Adequate Protection:

Building insurance is designed to provide financial protection in the event of property damage or loss. By staying up-to-date on the legal landscape, you can ensure that your insurance coverage adequately protects your property and aligns with your specific needs. Updating your coverage based on new risks or changes in regulations can help mitigate potential gaps in protection.

3. Competitive Advantage:

For businesses, having a comprehensive understanding of building insurance and staying informed about changes in the legal requirements can give you a competitive advantage. It allows you to make informed decisions when selecting insurance providers, negotiating terms, and managing risks.

Verifying and Contrasting Information:

While this article provides a general overview of the legal obligations associated with building insurance, it is essential to remember that laws and regulations can vary across jurisdictions. Therefore, it is crucial to consult with legal professionals or trusted sources, such as government agencies or insurance experts, to verify and contrast the information provided in this article specific to your circumstances.

Conclusion:

Understanding the legal obligations of building insurance is vital for property owners to comply with local laws, contractual obligations, and their duty of care. Staying up-to-date on this topic ensures compliance, adequate protection, and may offer a competitive advantage. Remember to verify and contrast the information provided to ensure its applicability to your specific situation.