As couples go through divorce proceedings, one of the major issues is the division of assets acquired during the marriage. Retirement assets, such as 401(k) plans, pensions, and IRAs, can be significant assets that are subject to division. However, determining how these assets should be divided can be a complex and contentious matter. In this article, we will explore the legal framework surrounding the division of retirement assets in divorce proceedings and whether a spouse can be entitled to half of these assets.

Divorce and Retirement: Understanding the Division of Retirement Assets in a Divorce

Divorce can be a difficult and emotional process, and one of the most complicated aspects is the division of assets. When it comes to retirement savings, it can be especially complex, as these assets are often some of the largest a couple may have.

What is Considered a Retirement Asset?

Retirement assets include any savings or investments that have been set aside for retirement, such as:

📋 Content in this article

- 401(k) plans

- Pensions

- Individual Retirement Accounts (IRAs)

- Stock options

- Deferred compensation

How are Retirement Assets Divided?

Retirement assets are typically considered marital property, meaning that they are subject to division during a divorce. The exact method for dividing these assets will depend on the laws of the state where the divorce is taking place.

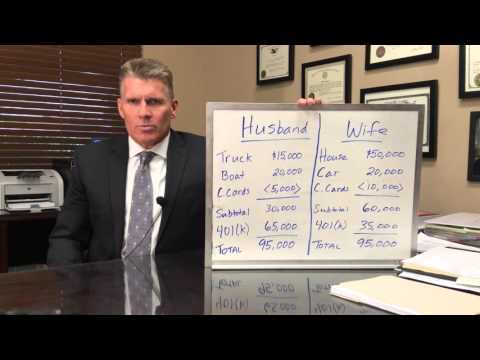

In some cases, the couple may decide to split the assets evenly. In other cases, one spouse may keep a larger share of the retirement assets, but in exchange, give up other assets of equal value.

What is a Qualified Domestic Relations Order (QDRO)?

A Qualified Domestic Relations Order (QDRO) is a legal order that divides a retirement plan between two spouses. This is often necessary because many retirement plans are governed by federal laws, which require a QDRO to divide the assets in a divorce.

It’s important to note that not all retirement plans are subject to a QDRO, and the rules for dividing retirement assets can vary widely between different types of plans.

What are the Tax Implications of Dividing Retirement Assets?

It’s important to consider the tax implications of dividing retirement assets during a divorce. Depending on how the assets are divided, one or both spouses may be subject to taxes and penalties.

For example, if one spouse withdraws money from a retirement account and gives it to the other spouse, they may be subject to taxes and penalties for early withdrawal.

Conclusion

Dividing retirement assets during a divorce can be a complex process, and it’s important to work with an experienced attorney who can help guide you through the process. By understanding the laws in your state and the tax implications of dividing retirement assets, you can work towards a fair and equitable division of your assets.

Divorce and Retirement Funds: Understanding Division of Assets

Divorce can be a complex and emotional process. One of the most significant issues that couples have to deal with is the division of assets. This can be particularly challenging when it comes to retirement funds. Retirement accounts are often one of the most valuable assets that a couple holds, and dividing them can be a complicated process.

What types of retirement funds are there?

There are two main types of retirement accounts: defined benefit and defined contribution. A defined benefit plan is a traditional pension plan that provides a fixed monthly payment for life. A defined contribution plan, on the other hand, is a retirement savings plan that allows employees to contribute a portion of their salary to an account that grows tax-free until retirement.

How are retirement funds divided?

The process of dividing retirement funds is known as qualified domestic relations order (QDRO). A QDRO is a legal document that gives a divorced spouse the right to a portion of the other spouse’s retirement benefits. The QDRO outlines the specific terms of the division, including the amount and timing of payments.

The amount of the division depends on the state laws and the specific circumstances of the divorce. In most cases, retirement benefits earned during the marriage are considered marital property and are subject to division. Benefits earned before or after the marriage are usually considered separate property and are not subject to division.

What are the tax implications of dividing retirement funds?

Dividing retirement funds can have significant tax implications. If the division is not done correctly, both parties may be subject to taxes and penalties. For example, if one spouse receives a lump sum payment from a 401(k) plan, they may be subject to income taxes and a 10% early withdrawal penalty if they are under the age of 59 ½.

To avoid these tax implications, it is essential to work with an experienced divorce attorney and a financial advisor who can help you navigate the complex process of dividing retirement assets.

Conclusion

Dividing retirement funds can be a complex process, but it is essential to ensure that both parties receive a fair share of the assets. Working with an experienced attorney can help ensure that your rights are protected and that the division is done correctly.

- Defined benefit plan: a traditional pension plan that provides a fixed monthly payment for life.

- Defined contribution plan: a retirement savings plan that allows employees to contribute a portion of their salary to an account that grows tax-free until retirement.

- Qualified domestic relations order (QDRO): a legal document that gives a divorced spouse the right to a portion of the other spouse’s retirement benefits.

Example:

John and Jane are getting divorced. John has a 401(k) plan with a balance of $500,000, which he earned during their 10-year marriage. Jane has a defined benefit plan with a monthly payment of $2,000, which she earned during their 10-year marriage. Using a QDRO, John will be entitled to a portion of Jane’s defined benefit plan, and Jane will be entitled to a portion of John’s 401(k) plan.

Understanding Your Entitlement to Your Spouse’s 401K in Divorce Proceedings: A Legal Overview

Divorce is a difficult and emotional process, and dividing property can often be one of the most contentious parts of it. If you or your spouse has a 401K, it’s important to understand your entitlement to it in divorce proceedings. Here’s a legal overview:

What is a 401K?

A 401K is a retirement savings plan that is typically offered by employers. Both you and your employer can make contributions to the plan, and the money grows tax-free until you withdraw it in retirement.

How is a 401K divided in a divorce?

In a divorce, a 401K is considered a marital asset, which means it is subject to division between the spouses. The specific rules for dividing a 401K vary by state, but there are generally two options:

- Option 1: The spouses can agree to a percentage of the 401K that each will receive.

- Option 2: The court can issue a Qualified Domestic Relations Order (QDRO), which is a legal document that divides the 401K according to state law.

What factors are considered when dividing a 401K?

When determining how to divide a 401K, the court will consider several factors, including:

- The length of the marriage

- The contributions made to the 401K by each spouse

- The financial needs and circumstances of each spouse

- The age and health of each spouse

What are the tax implications of dividing a 401K in a divorce?

Dividing a 401K in a divorce can have significant tax implications. If the division is done through a QDRO, the spouse who receives a portion of the 401K will not be subject to early withdrawal penalties or taxes as long as the money is transferred directly into an IRA or another qualified retirement plan. However, if the money is distributed directly to the spouse, taxes and penalties may apply.

It’s important to work with a qualified divorce attorney and financial advisor to understand your entitlement to your spouse’s 401K and the tax implications of dividing it in a divorce. With the right guidance, you can make informed decisions that protect your financial future.

Example: If you and your spouse have been married for 10 years and both contributed to the 401K during that time, you may be entitled to 50% of the total value of the plan. However, if your spouse made significantly more contributions to the plan than you did, you may be entitled to a smaller percentage.

Understanding the Division of Retirement Assets in Divorce Proceedings: Can Your Spouse Claim Half of Your Retirement Benefits?

Divorce is a complex and emotional process, and one of the most contentious issues couples face is dividing their assets. Retirement benefits are often a significant part of these assets, and it’s common for spouses to wonder whether their partner can claim half of their retirement benefits.

Understanding the Division of Retirement Assets

Retirement benefits earned during a marriage are generally considered marital property, and therefore subject to division during divorce proceedings. This includes pensions, 401(k) plans, IRAs, and other retirement accounts. However, the division of these assets can vary depending on the state laws and the specific circumstances of the divorce.

Equitable Distribution vs. Community Property

There are two systems for dividing assets in divorce proceedings: equitable distribution and community property. In states that follow the equitable distribution system, the court will divide property in a manner that is deemed fair and equitable, but not necessarily equal. In community property states, all property acquired during the marriage is considered equally owned by both spouses, and therefore subject to a 50-50 split.

Qualified Domestic Relations Order (QDRO)

If retirement benefits are subject to division, a Qualified Domestic Relations Order (QDRO) may be necessary. This is a legal order that outlines how retirement benefits will be divided between the spouses. A QDRO is required for certain types of retirement accounts, such as pensions and 401(k) plans, but not for others, such as IRAs.

Can Your Spouse Claim Half of Your Retirement Benefits?

Whether your spouse can claim half of your retirement benefits depends on several factors, including the state laws where you live, the length of your marriage, and the type of retirement account you have. In some cases, the court may award a smaller or larger share of retirement benefits based on the specific circumstances of the divorce.

Conclusion

Dividing retirement assets can be a complex and confusing process, but it’s important to understand your rights and obligations. If you’re going through a divorce and have questions about the division of retirement assets, it’s important to consult with an experienced divorce lawyer who can help guide you through the process.

Example:

- John and Jane have been married for 10 years and live in a community property state. John has a 401(k) plan with a balance of $100,000. During the divorce proceedings, the court awards Jane 50% of the 401(k) plan, or $50,000.