Welcome to this informative article on the impact of Lexington Law on rectifying late payments. Before we dive into the details, it’s important to note that while this article aims to provide you with valuable insights, it is always advisable to cross-reference with other sources and seek advice from legal professionals for specific cases. Now, let’s embark on this comprehensive analysis of how Lexington Law can help address late payments.

Removing Late Payments: Can Lexington Law Help You?

Removing Late Payments: Can Lexington Law Help You?

Late payments on your credit report can have a significant impact on your financial well-being. They can lower your credit score, making it harder to obtain loans or credit cards with favorable terms. If you’re struggling with late payments and their consequences, you may have heard of Lexington Law. In this article, we will provide a comprehensive analysis of the impact Lexington Law can have on rectifying late payments.

📋 Content in this article

The Role of Lexington Law

Lexington Law is a firm specializing in credit repair services. They aim to help individuals improve their credit scores by addressing inaccuracies and negative items on their credit reports. Late payments are one of the negative items that Lexington Law can assist with.

Understanding Late Payments

Before delving into how Lexington Law can help you remove late payments, it’s important to understand what late payments are. A late payment occurs when you fail to make a required payment on time. This can be for various types of debts, such as credit cards, loans, or mortgages. Late payments are typically reported to the credit bureaus after 30 days past the due date.

The Impact of Late Payments

Late payments can have a negative impact on your credit score and overall creditworthiness. They can stay on your credit report for up to seven years, making it difficult to obtain favorable interest rates or secure new lines of credit. Lenders view late payments as a sign of financial irresponsibility, which can lead to fewer borrowing opportunities or higher borrowing costs.

How Lexington Law Can Help

Lexington Law employs a team of professionals who are experienced in credit repair strategies and federal consumer protection laws. They work on behalf of their clients to challenge inaccurate or unfair late payment information on their credit reports.

After you engage Lexington Law, they will carefully review your credit report and identify any late payments that may be inaccurate or unfairly

Is Lexington Law Credit Repair Worth It? A Comprehensive Analysis and Evaluation

Is Lexington Law Credit Repair Worth It? A Comprehensive Analysis and Evaluation

In the vast world of credit repair, one name that often comes up is Lexington Law. As a potential client, you may be wondering if Lexington Law is worth the investment and if it can truly rectify late payments on your credit report. In this comprehensive analysis, we will delve into the impact of Lexington Law on rectifying late payments and evaluate whether it is worth your time and money.

1. The Role of Lexington Law in Credit Repair

Lexington Law is a reputable credit repair firm that assists individuals in improving their credit scores and resolving issues on their credit reports. Their team of professionals, including paralegals and attorneys, work closely with clients to identify and dispute inaccuracies, errors, and questionable items on their credit reports.

2. How Lexington Law Handles Late Payments

Late payments can have a significant negative impact on your credit score, making it difficult to secure loans or obtain favorable interest rates. Lexington Law addresses late payments by examining them for any inaccuracies or violations of consumer protection laws. They will then utilize their legal expertise to challenge or negotiate the removal of these entries from your credit report.

3. The Effectiveness of Lexington Law in Rectifying Late Payments

It is important to note that the effectiveness of Lexington Law in rectifying late payments can vary depending on the specific circumstances of each case. While they have a proven track record of success in credit repair, it is essential to manage expectations and understand that complete removal of accurate late payments may not always be possible.

4. The Benefits of Utilizing Lexington Law

– Expertise: Lexington Law employs professionals with a deep understanding of consumer protection laws and credit reporting regulations. Their knowledge can be invaluable in navigating the complex world of credit repair.

Title: The Impact of Lexington Law on Rectifying Late Payments: A Comprehensive Analysis

Introduction:

The issue of late payments has significant ramifications in various legal contexts, ranging from consumer protection to contractual agreements. In the United States, legal frameworks exist to address and rectify late payments, ensuring fairness and accountability in financial transactions. This reflection delves into the impact of Lexington Law, a prominent legal service provider, on rectifying late payments. It emphasizes the importance of staying current on this topic and underlines the need for readers to verify and cross-reference the content presented herein.

Understanding Late Payments:

Late payments refer to situations where a debtor fails to fulfill their financial obligations within the agreed-upon timeframe. Such delays can occur in diverse circumstances, including loan repayments, credit card bills, rent, and contractual agreements. Late payments can have adverse consequences for both creditors and debtors, potentially resulting in financial loss, damaged credit scores, legal disputes, and strained relationships.

Legal Protections for Creditors:

Creditors who suffer due to late payments have legal avenues to seek recourse. These protections vary depending on the specific nature of the debt and the applicable laws at both the federal and state levels. Commonly, creditors can utilize remedies such as late fees, penalties, interest accruals, and collection efforts to recover their dues. Additionally, various laws and regulations provide a framework for creditors to report late payments to credit bureaus, which can impact the debtor’s creditworthiness.

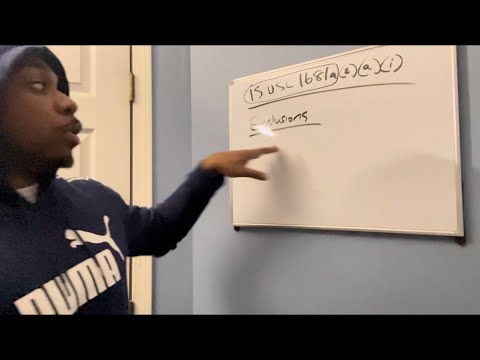

Consumer Protections against Late Payments:

Recognizing the potential harm caused by late payments, several consumer protection laws have been enacted in the United States. The Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA) aim to safeguard consumers’ rights and ensure fair treatment when it comes to debt collection and reporting practices.