As individuals approach retirement age, there are many factors to consider when deciding when to start receiving Social Security benefits. One major consideration is the impact of full-time work on these benefits. For those who plan to continue working past age 62, it is important to understand how this may affect their Social Security benefits and how to make informed decisions regarding their retirement income. In this article, we will explore the effects of full-time work on Social Security benefits at age 62, and provide insights and guidance to help individuals make the best decision for their financial future.

Social Security Benefits at Age 62: Calculating Potential Income While Employed

As you approach your 62nd birthday, you may be thinking about the social security benefits you will be eligible for. But did you know that if you are still employed when you turn 62, your benefits may be reduced?

Here are a few key things to keep in mind when calculating your potential income:

📋 Content in this article

- Full Retirement Age (FRA): Your FRA is determined by your birth year and is the age at which you are eligible to receive 100% of your social security benefits. If you were born between 1943 and 1954, your FRA is 66. If you were born in 1960 or later, your FRA is 67.

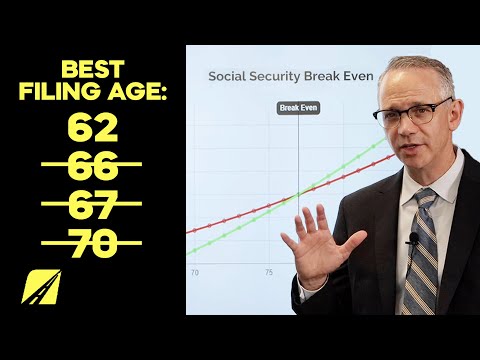

- Early Retirement: You can choose to start receiving benefits as early as age 62, but your benefits will be reduced by a certain percentage for each month you receive them before your FRA. For example, if your FRA is 66 and you start receiving benefits at age 62, your benefits will be reduced by 25%.

- Earnings Limit: If you continue to work while receiving social security benefits before your FRA, your benefits may be reduced if you earn more than a certain amount. In 2021, the earnings limit is $18,960. If you earn more than this amount, your benefits will be reduced by $1 for every $2 you earn above the limit.

- Impact on Future Benefits: If your benefits are reduced due to early retirement or the earnings limit, it may also impact the amount of benefits you receive in the future. Your benefits are based on your highest 35 years of earnings, so if you have several years with reduced or no earnings, it could lower your overall benefit amount.

Let’s look at an example:

John was born in 1959 and plans to retire at age 62 in 2021. His FRA is 66, so his benefits would be reduced by 25% if he starts receiving them at age 62. John also plans to continue working part-time and expects to earn $25,000 in 2021. Because he is earning more than the earnings limit of $18,960, his benefits will be reduced by $3,020 ($1 for every $2 earned above the limit). This means that John’s total social security benefits for 2021 would be $6,980 ($10,000 – $3,020).

Calculating your potential income can be complex, especially if you are still employed when you turn 62. It may be helpful to speak with a financial advisor or social security expert to ensure you are making the best decisions for your financial future.

Understanding Social Security Benefits: Balancing Retirement and Full-Time Employment at Age 62

For many Americans, Social Security benefits are a crucial part of their retirement plan. However, there are several factors to consider when deciding the best time to start receiving benefits. One of the most important decisions is whether to continue working full-time while receiving benefits at age 62 or to delay retirement to increase the monthly benefit amount.

Retirement Age

The full retirement age (FRA) for Social Security benefits varies depending on the year you were born. For those born between 1943 and 1954, the FRA is 66. For those born in 1960 or later, the FRA is 67. If you choose to start receiving benefits at age 62, your monthly benefit amount will be reduced by 30% if your FRA is 67 or by 25% if your FRA is 66. This reduction is permanent and will affect your benefits for the rest of your life.

Working Full-Time

If you choose to continue working full-time while receiving benefits at age 62, there are income limits to consider. In 2021, if you earn more than $18,960 per year, your benefits will be reduced by $1 for every $2 earned above that limit. However, once you reach your FRA, there is no limit on the amount you can earn while receiving benefits.

Delaying Retirement

If you delay retirement and start receiving benefits after your FRA, your monthly benefit amount will increase.

For each year you delay, your benefit amount will increase by 8% up to age 70. For example, if your FRA is 66 and you delay retirement until age 70, your monthly benefit amount will increase by 32%.

Consider Your Options

When deciding whether to start receiving Social Security benefits at age 62, it is important to consider your personal financial situation and retirement goals. If you need the income and are willing to accept a reduced benefit amount, starting benefits at age 62 may be the best option. If you can delay retirement and increase your benefit amount, it may be worth waiting.

Conclusion

Understanding Social Security benefits is crucial to making informed decisions about retirement. Balancing retirement and full-time employment at age 62 can be challenging, but with careful planning and consideration, you can make the best decision for your financial future.

- Starting benefits at age 62 reduces monthly benefit amount by 25-30%

- Earning more than $18,960 per year while receiving benefits reduces monthly benefit amount

- Delaying retirement and starting benefits after FRA increases monthly benefit amount by 8% per year up to age 70

For example, if John’s FRA is 66 and his monthly benefit amount would be $2,000, starting benefits at age 62 would reduce his monthly benefit amount to $1,500. If John continues to work full-time and earns $25,000 per year, his benefits would be reduced by $3,520 ($1 for every $2 earned above the limit of $18,960). If John delays retirement until age 70, his monthly benefit amount would increase to $2,640, an increase of 32%.

Maximizing Social Security Benefits: The Impact of Continuing Wages After Age 60

As the majority of Americans rely on Social Security as a primary source of income during retirement, it is crucial to understand how to maximize the benefits you receive.

One factor that can greatly impact your Social Security benefits is continuing to work and earn wages after the age of 60.

Firstly, it is important to note that your Social Security benefits are calculated based on your highest 35 years of earnings. Therefore, if you continue to work and earn a higher income after the age of 60, it can replace one of your lower-earning years in the calculation and potentially increase your overall benefit amount.

Secondly, if you decide to take early retirement (at age 62) and continue to work, there is a limit to how much you can earn without a reduction in your Social Security benefits. In 2021, for example, the limit is $18,960. If you earn more than this limit, your benefits will be reduced by $1 for every $2 you earn above the limit.

Thirdly, if you wait until your full retirement age (which ranges from 66 to 67, depending on your birth year) to start receiving Social Security benefits, you can work and earn as much as you want without any reduction in your benefits.

It is also important to keep in mind that continuing to work and earn wages after the age of 60 can have tax implications. Your Social Security benefits may become taxable if your combined income (which includes your wages, pension, and other sources of income) exceeds a certain limit.

Retirement Income Projections for Individuals Planning to Retire at Age 62 in 2023

Planning for retirement can be a daunting task, especially when it comes to determining how much income you will have during your retirement years. For individuals planning to retire at age 62 in 2023, it is important to consider various factors that can impact retirement income projections.

Factors Affecting Retirement Income Projections

Retirement income projections take into account several factors that can affect how much income you will have during retirement. These factors include:

- Social Security benefits: Social Security benefits are a major source of income for many retirees, and the amount of benefits you receive will depend on several factors, including your earnings history and the age at which you begin receiving benefits.

- Retirement savings: Your retirement savings, including 401(k) plans, IRAs, and other investments, will also play a significant role in your retirement income projections.

- Expected rate of return: Your expected rate of return on your retirement savings can impact how much income you will have during retirement.

- Inflation: Inflation can erode your purchasing power over time, so it is important to factor in inflation when projecting your retirement income.

Retirement Income Projections for Age 62 Retirees in 2023

According to recent projections, an individual planning to retire at age 62 in 2023 can expect to receive an average monthly Social Security benefit of $1,503. This amount will vary depending on a variety of factors, including your earnings history and when you begin receiving benefits.

Assuming an average rate of return of 6%, a retiree with $500,000 in retirement savings can expect to withdraw approximately $2,625 per month during retirement. However, it is important to note that this amount may not keep up with inflation, which typically averages around 3% per year.

Overall, retirement income projections can be complex and dependent on various factors. It is important to work with a financial advisor to determine a retirement plan that is tailored to your specific needs and goals.